A liability insurance is included to cover up a possible damage to other people's property. This covers the three major types of loss that might occur when using your vehicle.

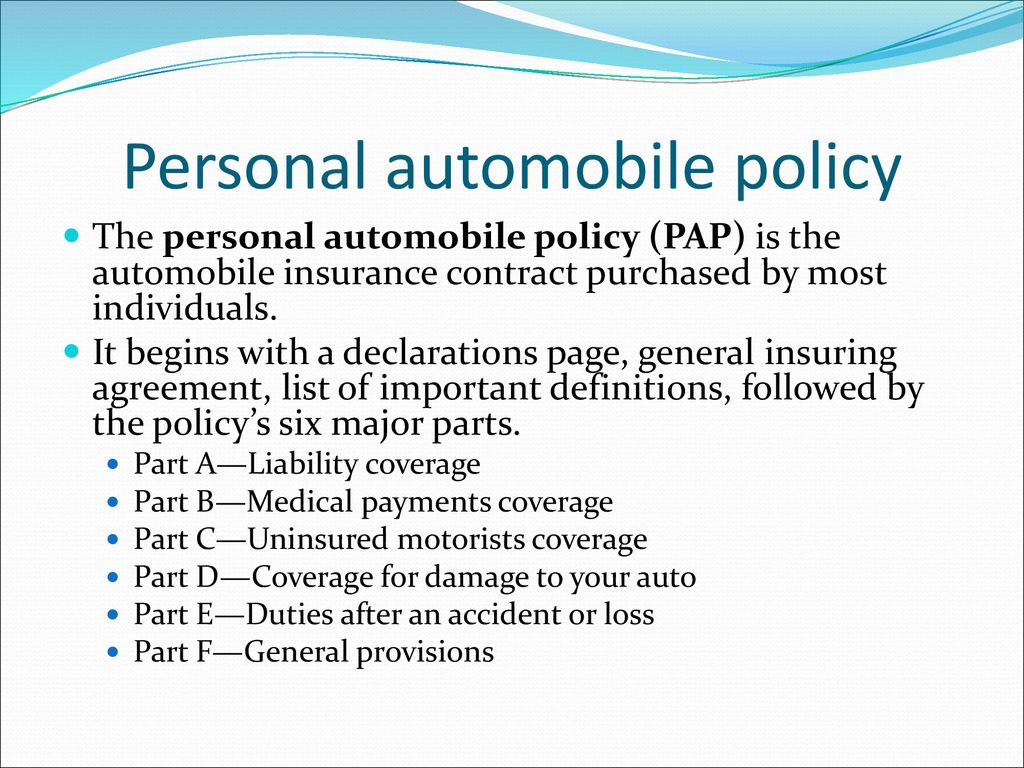

Hand Out 6 Auto Insurance - Ppt Download

The coverage included in an automobile insurance policy that covers property damage is liability insurance.

The coverage included in an automobile insurance policy weegy. Full coverage is a phrase used to describe an auto insurance policy that includes liability, comprehensive coverage, and collision. Insurance, hopefully can give benefits to all. The answer to question the coverage included in an automobile insurance policy that covers property damage is.

If you're a passenger in a car accident, your medical expenses will usually be covered by your driver's insurance or the other driver's policy, depending on fault. This type of coverage is set in place as a requirement by state law. The garage coverage form covers liability arising out of which of the following?

Indicate the type(s) of auto insurance coverage included in the policy provided. The coverage included in an automobile insurance policy that covers property damage is insurance. This term, however, generally refers to legally required coverage added to the auto policy to compensate you and members of your family who are injured in an auto accident.

This coverage, as discussed earlier, is called personal injury protection (pip). Total payments under pip are limited to $10,000 per person, per incident. Well, if you guys are still looking for another answer use the menu search or look at the related articles.

The emerson first national bank is lending you money to buy a new car the loan agreement will probably state that you must carry blank insurance Which portion of the garage coverage form covers liability for damage to property of others in the insured's care, custody, or control? Brinacodychag is waiting for your help.

The coverage included in an automobile insurance policy that covers property damage is liability insurance. You can also use your personal car insurance policy to cover your injuries if you have certain types of coverage, like personal injury protection. The coverage included in an automobile insurance policy that covers property damage is liability insurance.

Comprehensive covers events such as fire, falling objects, missiles, explosion, earthquake, windstorm, hail, flood, vandalism, riot, or contact with animals such as birds or deer. There are many insurance companies offering ‘n’ number of products for customers. The abbreviation would be 25/50/25.

The coverage included in an automobile insurance policy that covers property damage is _____ insurance the coverage included in an automobile insurance policy that covers. Are you sure stock in the bree medical supply companies quoted at 35 1/4 suppose you have a. Which of the following coverages are provided by business auto physical damage coverage?

Jane has a checkbook balance of 68.00, then two , ono for 55, 00 and one for. This is an abbreviated way to show the limits of a minimum coverage car insurance policy. |score 1| jher000 |points 7937|.

A liability b supplemental c major medical d term. The coverage included in an automobile insurance policy that covers property damage is liability insurance. 5 types of car insurance coverage explained.

The coverage included in an automobile insurance policy that covers property damage is liability insurance. If you are buying the car insurance policy for the first time, it will be an overwhelming experience. View the fine print auto insurance policy.docx from economics managerial at west high school.

This coverage reimburses you for loss due to theft or damage caused by something other than a collision with another car or object. Additionally, you may be used as a witness during the insurance. The payment usually is not paid to the insured but rather to the third party that claimed it.

Personal injury protection (pip) is a mandatory coverage in florida. Liability insurance is designed specifically to offer a specific protection against a third party claim. Auto insurance policies that insure for property damage is referred to as liability coverage.

For example, drivers in ohio are required to carry $25,000 in bodily injury coverage per person, $50,000 in bodily injury coverage per accident, and $25,000 in property damage coverage.

Compare Auto Insurance Quotes For Top Rates

The Ukrainian Weekly 1993

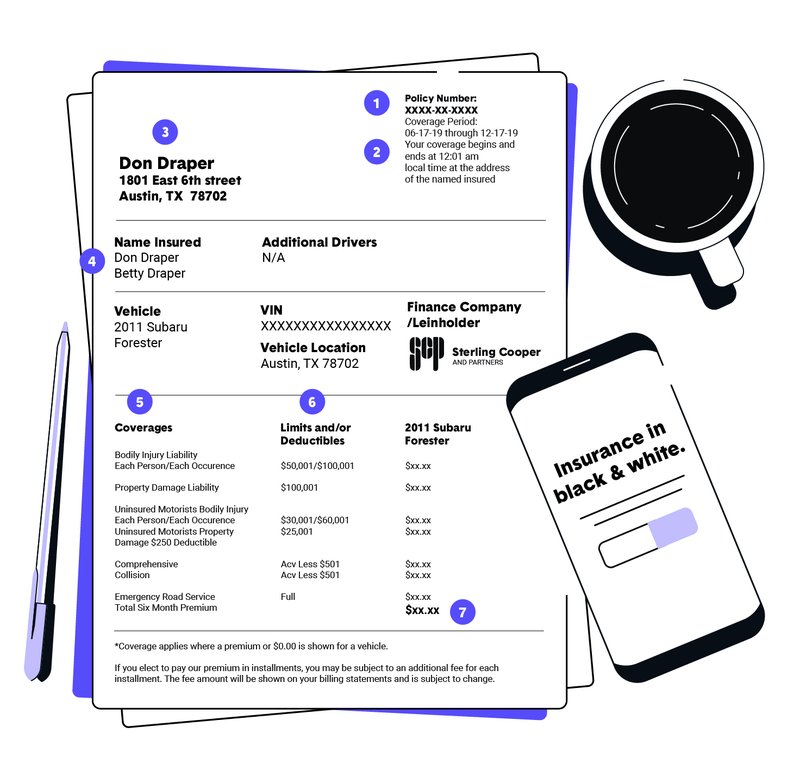

How To Read A Car Insurance Policy The Zebra

Pdf Opportunities Of Base Of The Pyramid From The Perspective Of Resources And Capabilities Surapaneni Mohana Murali Krishna - Academiaedu

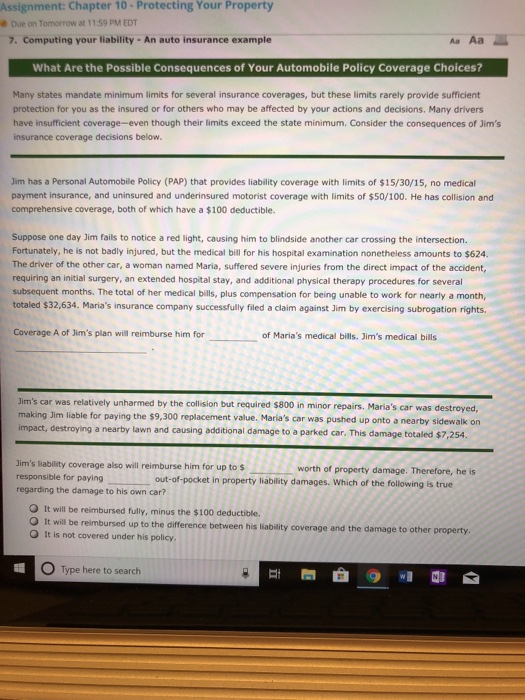

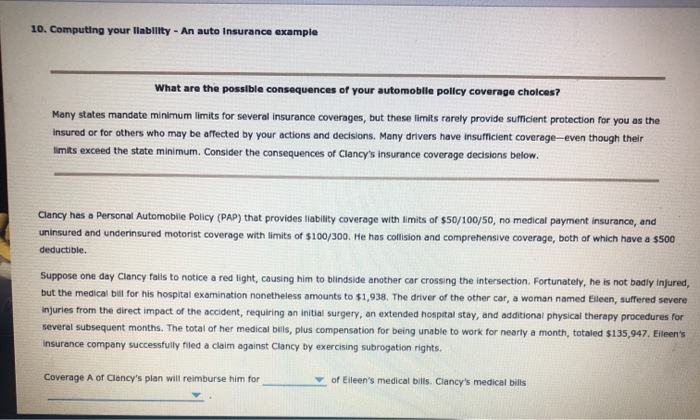

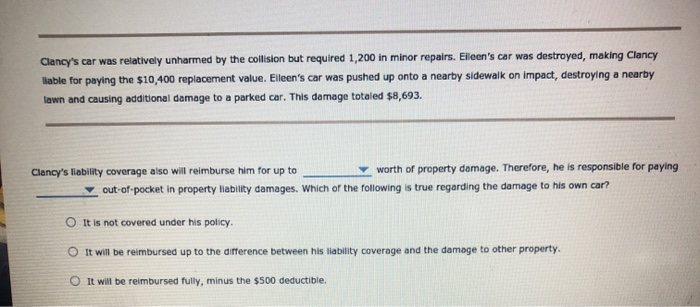

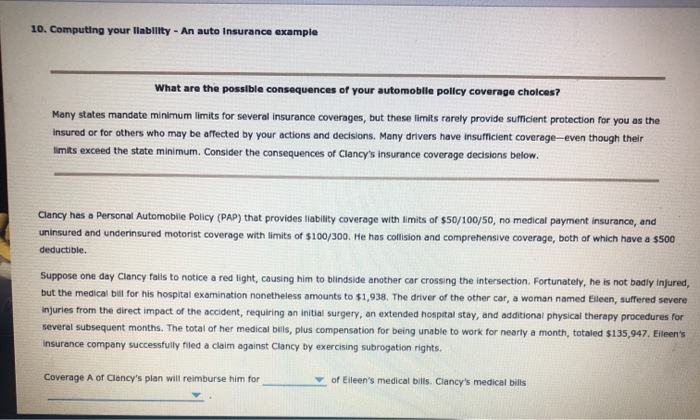

Solved 10 Computing Your Ilability - An Auto Insurance Cheggcom

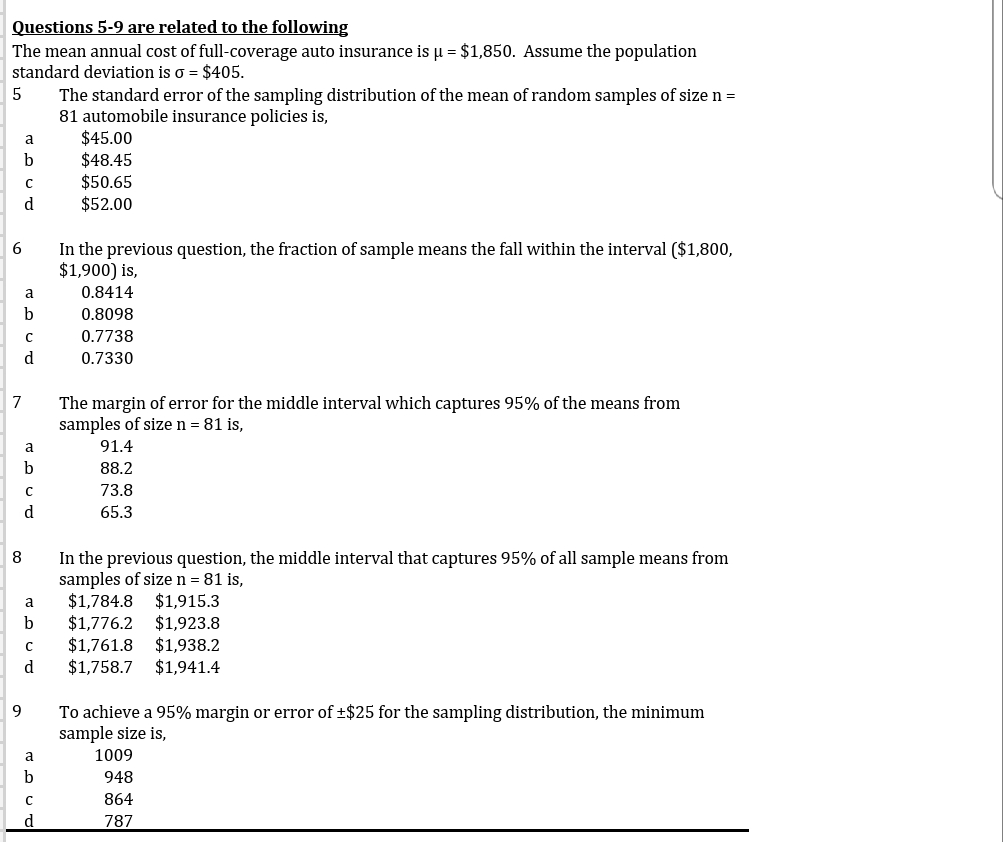

Solved Questions 5-9 Are Related To The Following The Mean Cheggcom

Insurance

Full Coverage Does Not Exist - Rafi Law Firm

Blanca B347 By Sol Times - Issuu

Insurance

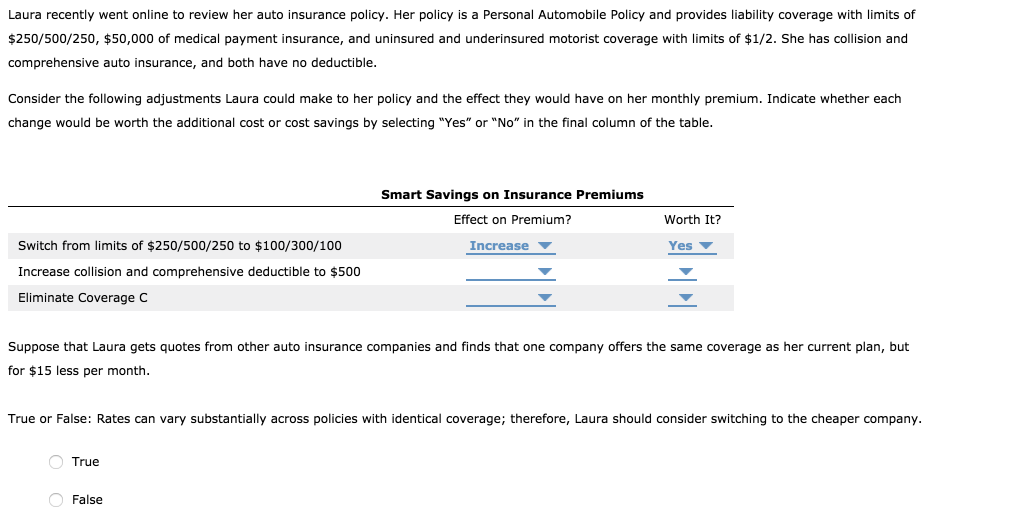

Laura Recently Went Online To Review Her Auto Cheggcom

Solved Your Assignment Chapter 10- Protecting Due On Cheggcom

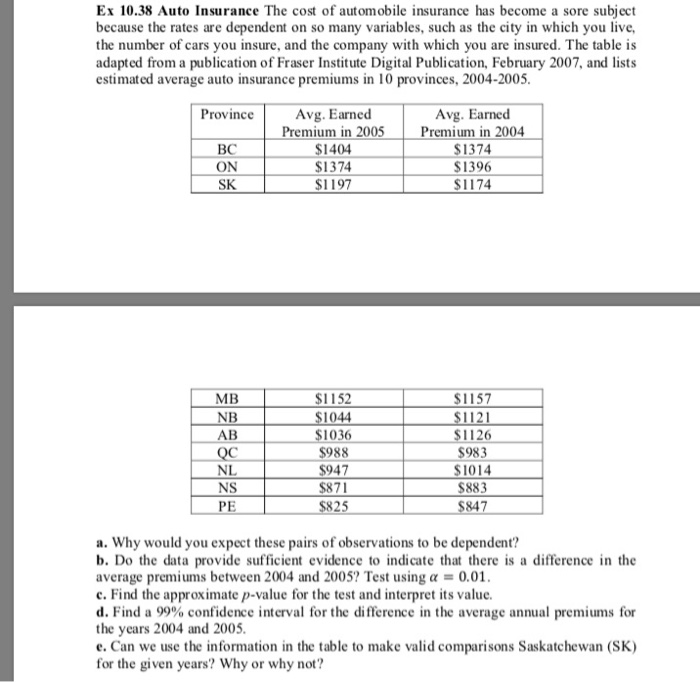

Solved Ex 1038 Auto Insurance The Cost Of Automobile Cheggcom

Business Management Ethics And Communication

Finn Valley 13 07 17 By River Media Newspapers - Issuu

Solved 10 Computing Your Ilability - An Auto Insurance Cheggcom

What Is Comprehensive Insurance The Hartford

Insurance

Quantcast Top Million Websites November 2012 Pdf