In 2018, the average inpatient hospital stay was $2,517, according to the kaiser family foundation. Keep in mind that hospital indemnity is a supplement to your medical insurance, it is not health insurance.

Disability Insurance - Rbc Insurance

Critical illness insurance, also known as catastrophic illness or dread disease insurance, is an additional health insurance policy that can help cover the exorbitant costs of serious maladies.

Hospital indemnity insurance worth it reddit. Also, we decided to go with supplemental life insurance covering us at $124,000 ($1.98 a pay period) above the $31,000 of life insurance the employer provides for free. $1,000 for the hospital admittance. Ad compare top expat health insurance in indonesia.

And expense reimbursed supplemental insurance has similar tax efficiency* to health accounts, too. Hospital indemnity insurance is meant to supplement your medical insurance, not replace it, so it’s as important to understand what it won’t cover as what it will. Dave’s dos & don’ts on insurance.

You are in the hospital for 3 days. Insurance is an important part of any financial plan. If you stay overnight at the hospital, your indemnity insurance will.

Supplemental insurance for medical issues. It won’t pay for your medical bills from your doctors, hospitals or for your medications from the pharmacy. Hospital indemnity insurance is very similar to accident insurance.

Hospital indemnity insurance is a type of policy that helps cover the costs of hospital admission that may not be covered by other insurance. With a comprehensive health insurance plan, you are still responsible for copays and coinsurance. A hospital indemnity plan may pay:

Whether you choose one over the other or get both will depend on your lifestyle, expenses, and savings. At the same time, the average annual deductible for an individual has also climbed, up 49 percent over the last five years, from nearly $1,000 in. Also, we decided to go with supplemental life insurance covering us at $124,000 ($1.98 a pay period) above the $31,000 of life insurance the employer provides for free.

Fixed indemnity products are offered in problematic and nontransparent ways in the individual market for health insurance and by employers offering coverage to their workers. It transfers risk away from the individual in exchange for a premium payment. The more serious the injury, the more you’ll benefit from an accident policy.

If you can afford to take the risk, you don’t need to pay for insurance to protect you. Consider if hospital indemnity insurance is worth it for the benefits. Since hospital indemnity insurance is a sum of money paid to you relative to the terms of your plan, providers cannot deny your insurance.

1 hospital does not include certain facilities such as nursing homes, convalescent care or extended care facilities. On my own i never thought indemnity would be helpful, but my wife's family has a history of some serious illnesses. On top of that, you are still required to pay your annual deductible before your plan will start.

She is also keeping her private 10 year term life insurance policy at $10 a month for a $150,000 policy. You may choose to use the benefit payments you receive from a. In some of my reading up on the subject i read that hospital stays cost upwards of $10k on average, though i would expect her blue cross blue shield / peehip (she's a teacher in.

This, in a nutshell, is hospital indemnity insurance. It is also used to supplement any expenses incurred outside of your health coverage. $3,000 for each day in the hospital ($9,000) you receive a check for $10,000 and use the money to pay for your hospital bills and anything else.

It is very valuable in some key areas to help avoid financial devastation but can also be a drag on your ability to get out of debt and grow wealth if the wrong plans are. Think of the aflac commercials you've probably seen where they give. Get the best quote and save 30% today!

That means it’s designed to complement traditional health insurance, not replace it. Health (4 days ago) the hospital plan is going to be a set cash dollar amount that they pay to you if you are hospitalized. This pays off for people who are dead broke and have no parents to rely on or those who know they have a medical condition that often sends them to the er and leaves them in the hospital for a couple of days.

Basically, my employer offers a hospital indemnity insurance plan through cigna. Supplemental insurance provides real insurance value, more than just a dollar value. It won’t pay medical bills from your doctors or hospitals, nor will it pay for your medications from the pharmacy.

Insurance is all about transferring risk. Plans typically provide benefits to. Basically, if you (or anyone covered under the plan) gets admitted to the hospital you get paid $1000, and then $200 for each day you are at the hospital thereafter.

Supplemental health insurance is no longer the. 2 covered services/treatments must be the result of an accident or sickness as defined in the group policy/certificate. You decide how to spend the money.

You probably don't need this one unless you expect to be hospitalized overnight at least once. Is hospital indemnity insurance worth getting? Ad compare top expat health insurance in indonesia.

Hospital indemnity insurance worth it reddit.accident insurance policies pay a benefit upon a covered accidental injury. While you may use the cash you receive for these expenses, hospital indemnity payments are meant to help you fill the gap for. Hospital indemnity insurance provides a set cash payment to use for any bills you need to.

Get the best quote and save 30% today! It’s a pretty black and white arrangement. One popular accident insurance policy on the market would cover $1,400 of that cost.

Seems nice, and if you are unhealthy or expect to be admitted then maybe something to consider. Hospital indemnity accident insurance critical illness. It will be separate from your medical plan and will pay x dollars for being in the hospital for the delivery, x dollars for the newborn's care, etc.

It is a type of supplemental insurance.

Disability Insurance - Rbc Insurance

:max_bytes(150000):strip_icc()/northwestern-mutual-28c5fca0a53242388e472f9f990e4ff3.png)

The 6 Best Long-term Disability Insurance Of 2021

Disability Insurance - Rbc Insurance

Disability Insurance - Rbc Insurance

:max_bytes(150000):strip_icc()/assurity-0401145f96ff47bea7a6c2df1d6645b7.png)

The 6 Best Long-term Disability Insurance Of 2021

Disability Insurance - Rbc Insurance

Top 4 Health Insurance Plans Available In India

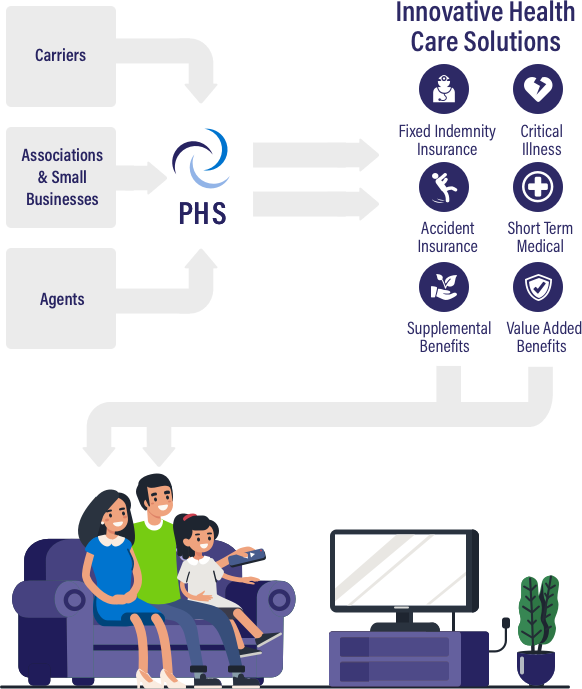

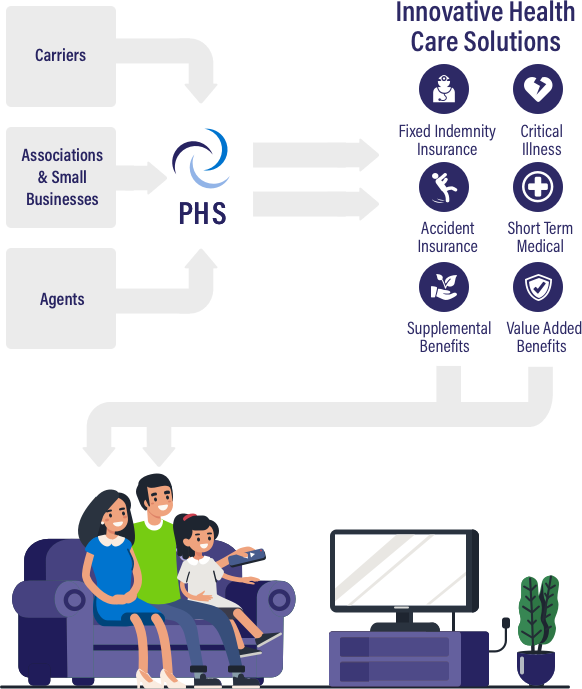

Premier Health Solutions Benefits Administration Management Premier Health Solutions

Aflac Inc Headquarters All Office Locations And Addresses

:max_bytes(150000):strip_icc()/guardian-direct-61e9b1d11c3049f09f24c3419ac683b6.jpg)

The 6 Best Long-term Disability Insurance Of 2021

Wqg_0v_xr6cukm

2

Best Vivo 5g Mobile Phones In India Oct 2021 - Price Specs Bajaj Finserv

Mczdwfoot5yozm

![]()

Faqs - Greater Alliance

Dfw Connectedcare Myaacom

Firewall Comics Character Fictional Characters

Disability Insurance - Rbc Insurance

Professional Indemnity Insurance Aps