Without the contribution caps of 401 (k)s or other qualified savings plans, overfunded life insurance is a safe option for retirement savings that is protected from market volatility and is accessible for early retirement before age 59 ½ without penalty. Using life insurance policies to save for retirement may.

Can Life Insurance Be Used As A Retirement Plan

But today, the power of insurance cash values to create.

Why overfunding life insurance makes retirement sense. Life insurance contracts have traditionally been accorded highly favorable income tax treatment. Retirement cash needs are satisfied from the lirp via policy loans and withdrawals. Worry less about the future with term life insurance.

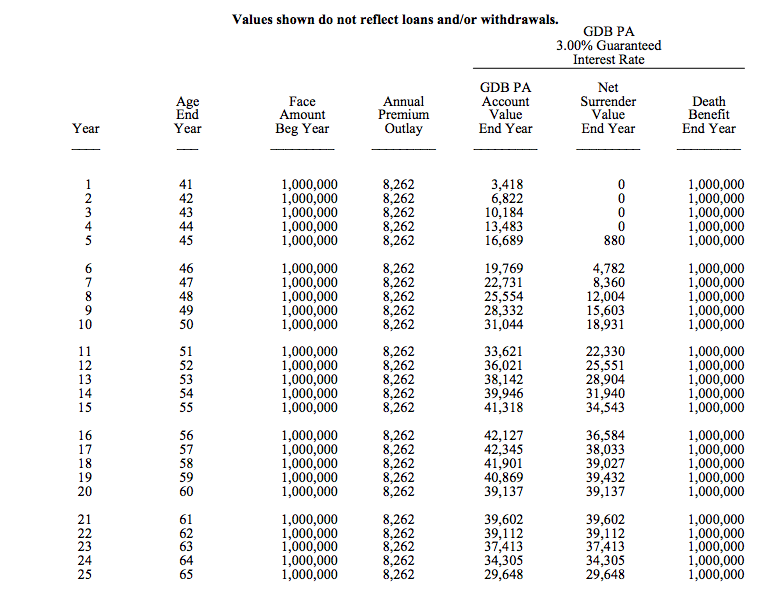

Why overfunding life insurance makes retirement sense. Sometimes overfunded whole life is used as a part of a planning strategy for affluent individuals who already maximized other available retirement plans and still want to contribute more. For clients that have the means to invest more and who are focused on mitigating taxes in retirement, overfunded life insurance offers a valuable third option.

Think of it like this. You typically need to pay a certain premium each year or each month to ensure. In fact, rates for whole life insurance can be as much as five to.

Whole life insurance was never meant to be an investment vehicle, and it's certainly not. Why life insurance shouldn't be used to fund retirement. Leland lee davis he power of life insurance death benefits inside a comprehensive wealth management plan is well understood.

Moreover, we are in such a unique and exciting position because we get to learn every day from some of the best in the business financial professionals in the life insurance arena. When you own a cash value life insurance policy, ownership builds equity (i.e., cash value). Also known as a lirp life insurance retirement plan, these oli policies are designed to offer maximum early high cash value along with the asset protection and tax benefits of life.

The two main types of coverage life insurance companies offer are term and permanent life. The idea is that they build cash value quickly that you can access for any reason. However, with indexed universal life insurance consumers may choose to pay higher premiums because it provides the death benefit protection they desire but also the ability to accumulate cash value that can be accessed for various reasons such as:

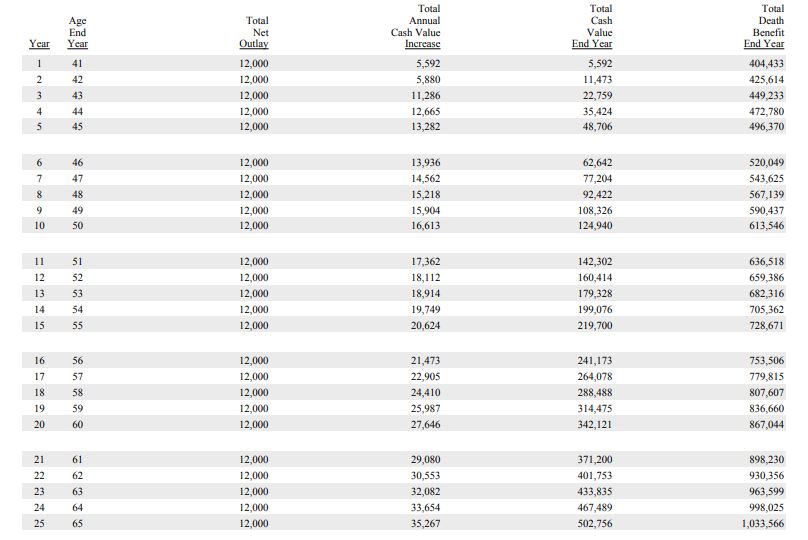

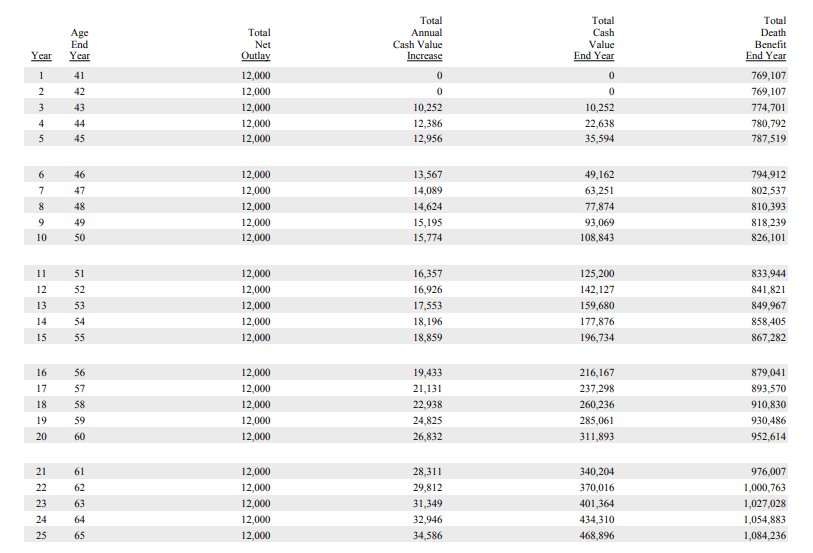

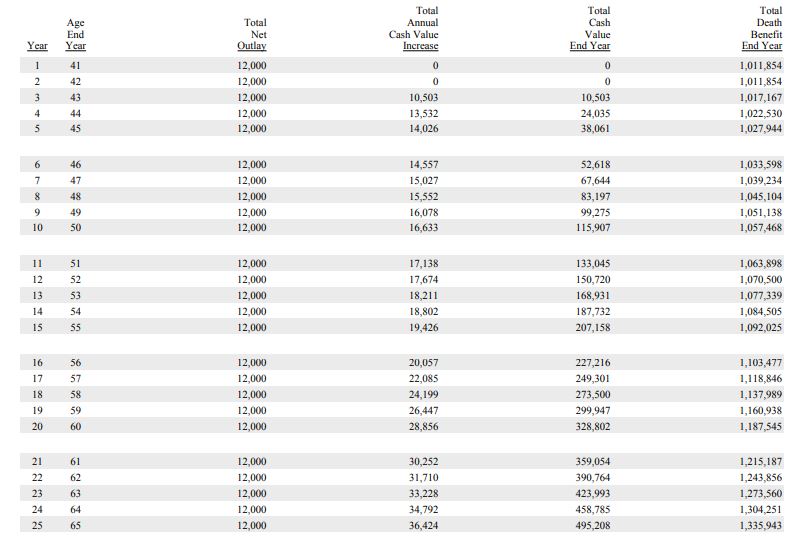

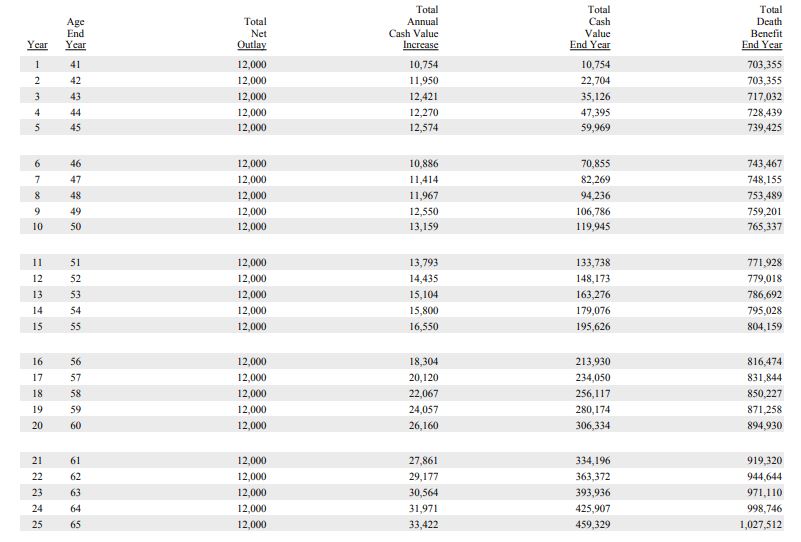

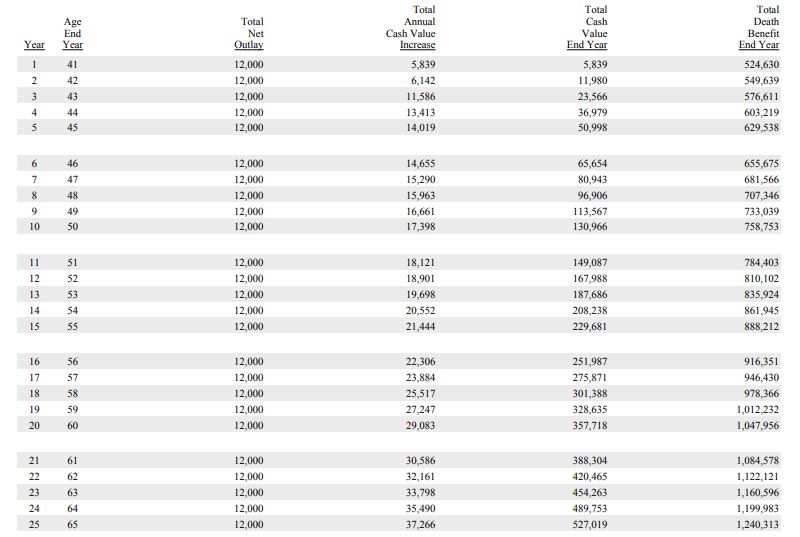

1) whole life insurance costs too much. Overfunded cash value life insurance maximizes cash value and minimizes death benefits. Overfunded life insurance is when you pay more into a policy than is required.

Here at life insurance think tank, we are fortunate to work some of the best and brightest life insurance and legacy planners in the country. To “ overfund ” an indexed universal life insurance policy means to maximize the policy’s cash value growth potential and minimize its net insurance costs over time. Life insurance is meant to protect families from loss of income.

Using life insurance to supplement retirement cash flow by overfunding a cash value life insurance policy. Ad don’t delay on getting term life insurance. Keep in mind that typically life insurance premiums are not tax deductible.

What is overfunded life insurance? Emergencies, education expenses, retirement funds, etc. So, by overfunding your policy, you contribute more to the cash value.

Quick overview of overfunded cash value life insurance policies. Why overfunding life insurance makes retirement sense amassing large sums in a life insurance policy can create a remarkably efficient income stream for the right client. Worry less about the future with term life insurance.

When the maximum premium is paid into the policy, cash values grow faster which leverages the net amount of life insurance at risk. Also, this cash value grows predictably and safely. Term life insurance is less expensive than whole life.

Permanent life insurance policies, such as whole life insurance or universal life insurance, have a cash value component. Ad don’t delay on getting term life insurance. A life insurance retirement plan (lirp) is a permanent life insurance policy that uses the cash value component to help fund retirement.

Term life insurance is cheaper.

Do You Really Want That Overfunded Cash Value Life Insurance Policy

Overfunded Life Insurance The Insurance Pro Blog

Minimum And Maximum Over-funded Life Insurance Policies Innovative Retirement Strategies Inc

Why I Love Overfunded Whole Life Insurance 2019 - Youtube

Is An Overfunded Life Insurance Policy Right For You - Gant Insurance

Overfunded Life Insurance Paradigm Life Make It Pay Off

Life Insurance Loans A Risky Way To Bank On Yourself

What Is Overfunded Life Insurance

Do You Really Want That Overfunded Cash Value Life Insurance Policy

What Is Overfunded Life Insurance

Do You Really Want That Overfunded Cash Value Life Insurance Policy

Do You Really Want That Overfunded Cash Value Life Insurance Policy

Super Roth Should You Overfund Supplemental Executive Retirement Plan Insurance Ymyw Podcast 312 - Youtube

Overfunded Life Insurance 15 Pros And Cons

Do You Really Want That Overfunded Cash Value Life Insurance Policy

Do You Really Want That Overfunded Cash Value Life Insurance Policy

Do You Really Want That Overfunded Cash Value Life Insurance Policy

Life Insurance Loans A Risky Way To Bank On Yourself

Is An Overfunded Life Insurance Policy Right For You - Gant Insurance