For instance, if your household has monthly commitments of about rm2,000 , give or take, you will need about rm24,000 per year to cover the running cost. Renewable term is still sold today but typically only as a method of renewing a level term life insurance policy.

What Is Sum Assured Max Life Insurance

Premiums are payable to a stated date or to the insured’s death, if earlier.

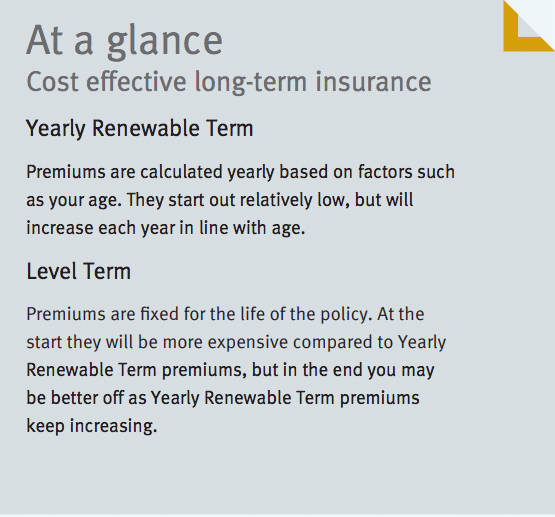

Renewable term life insurance example. When you purchase a term life insurance policy, it will last for a specific term length, usually from 5, 10, 15, 20, and 30 years. Level term life insurance is the product of choice for many individuals and families who require a lot of coverage at very affordable rates. Tit automatically renews every 5 years until age 74 without any proof of insurability.

For example, you may be waiting for estate and trust matters to be resolved, or you may not have the money to buy a policy with a longer coverage period. Renewal is automatic to a Signed for massachusetts mutual life insurance company.

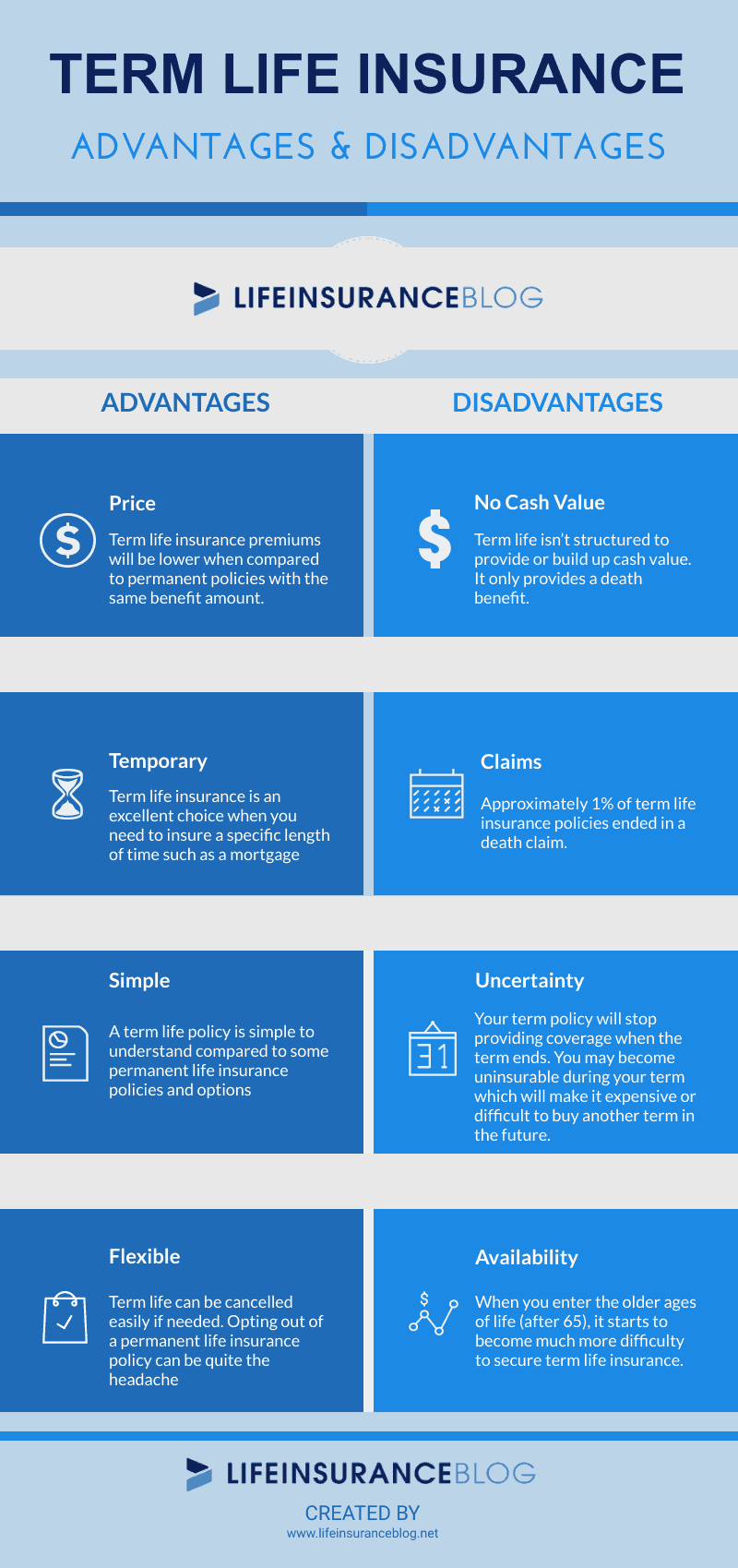

Ad term life insurance made easy. Decreasing term life insurance also offers a set premium, but the death benefit decreases over the life of the policy. Since term life insurance policies cover you for a limited period instead of your entire life, premiums can be much more affordable than permanent life insurance.

A level term policy is the most common form of term life insurance and provides a set death benefit if you die while the policy is active, for which you pay a premium that stays the same for the life of the policy. Unlike traditional term life insurance, premiums start low and increase every time you renew your policy. So, if you become unable to qualify for new coverage medically, you won’t.

Basically, guaranteed renewable term life insurance means if you find you have a need for life insurance that is longer than the original term you purchased, you are guaranteed the option to extend the term should you need to in the future, when your first term life policy expires. At the end of this term period, almost every company gives you the option to renew your policy without having to prove proof of insurability. How annually renewable term insurance works.

Based on your current age and health, you may be looking at double the amount of premium for the same $100,000 worth of coverage. Ad term life insurance made easy. Term life insurance your way.

Examples of permanent coverage include whole life insurance and universal life insurance. Term life insurance your way. Annual renewable life insurance works just like a term life policy with a longer coverage period.

Because james has renewable term life insurance, he can extend his policy when the term ends without having to undergo a medical exam or report his new (and rather risky) job. It is a 5 years renewable term insurance from sun life that provides guaranteed life coverage equivalent to twice the face amount until age 75. A renewable term life insurance policy allows you to simply extend your current coverage at the end of term at an annually increasing rate.

The yearly renewable term plan of reinsurance is a type of life reinsurance where mortality risks of an insurance company are transferred to a reinsurer through a process referred to as cession. His term life insurance coverage ends the same year that emily enters her dream college. Having a convertible term life insurance policy means that at any point during your term or before your 70 th birthday (whichever comes first), you have the option to convert your term life coverage to whole life coverage.

Check the policy for the fee amount. At the age of 30, you plan to be insured for the next 10 years. The amount you would want to cover with term life is approximately rm240,000.

Renewable and convertible term rider 7 your exchange privilege if this rider is a term 10 insurance plan, you may exchange all or part of the death benefit of this rider for a rbc life insurance company term 15, term 20 or term 30 rider without evidence of insurability, subject to the following conditions:

2021 Guide To Term Life Vs Whole Life Insurance Definition Pros Cons

Best Term Insurance In The Philippines Ultimate Guide In Getting Insured

Northwestern Mutual Life Insurance Review Best For Smokers - Valuepenguin

Best Term Insurance In The Philippines Ultimate Guide In Getting Insured

Best Term Insurance In The Philippines Ultimate Guide In Getting Insured

Voluntary Life Insurance Quickquote

What Is Life Insurance Exact Definition Meaning Of Life Insurance

What Are The Three Main Types Of Life Insurance The Insurance Pro Blog

5 Year Term Life Insurance Policy Insurance Geek

Term Life Insurance Policygenius

Compare Stepped Vs Level Life Insurance Premiums Updated

Life Insurance Over 70 How To Find The Right Coverage

What Are The Three Main Types Of Life Insurance The Insurance Pro Blog

/manwithsonandlaptop-b3e0b4a123824754bd4bc3a2833a48bf.jpg)

What Is Annual Renewable Term Art Life Insurance

Term Life Insurance Explained Forbes Advisor

5 Year Term Life Insurance Policy Insurance Geek

Types Of Life Insurance Fidelity Life

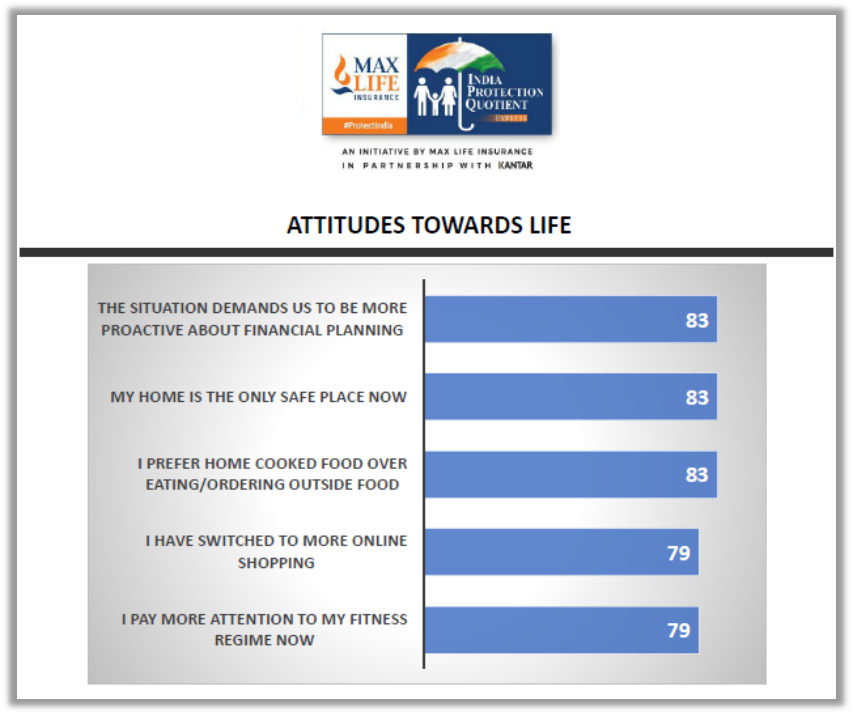

Advantages And Disadvantages Of Term Life Insurance Top 9 Facts

Best Term Insurance In The Philippines Ultimate Guide In Getting Insured