The maximum amount an insurer will pay An aggregate limit is a maximum amount an insurer will reimburse a policyholder for all covered losses during a set time period, usually one year.

![]()

General Aggregate Limits A Potential Insurance Risk Hiding In Plain Sight - Mycoi

They meet your needs because they give you the ability to customize your insurance to reflect your risk exposure and budget.

What does aggregate limit mean in insurance. Insurance policies typically set caps on both individual claims and the aggregate of claims. The term is also known as “general aggregate limit of liability,” which is the maximum amount of money an insurance company will pay for claims, losses, and lawsuits that happen during the. Sometimes called annual aggregate limit.

Understanding aggregate limit of liability. An aggregate annual deductible is the maximum amount policyholders need to pay within a policy period before their insurer pays for covered losses. The aggregate limit is the maximum amount the insurer will pay for any claim made during the policy period, which is normally one year.

It may be definitive, as in a general lifetime maximum for claims, or it may be set annually (like $500,000 per year). For example, if a doctor has purchased a medical professional liability insurance police the liability insurance coverage may be. Insurance policies typically set caps on both individual claims and the aggregate of claims.

The aggregate limit is the limit of liability available to each individual claim as well as all claims in the aggregate ie one large claim could erode the entire limit for the policy period and the aggregate limit typically doesn’t have a reinstatement. What does aggregate limit mean? The aggregate limit is usually double the occurrence limit.

Once the claims amount to this limit, the policyholder must cover any expenses thereafter. The maximum amount that an insurance policy will provide over a given period of time or over the life of the policy. Many insurance policies have what is called an aggregate limit.

An aggregate limit is a maximum amount an insurer will reimburse a policyholder for all covered losses during a set time period, usually one year. General aggregate limit — the maximum limit of insurance payable during any given annual policy period for all losses other than those arising from specified exposures. Aggregate limit means the amount stated in the schedule which represents our maximum liability for any and all claims made by all insured persons under any and all benefits, and if at any time the total value of unpaid claims would, if paid, result in the aggregate limit being exceeded, the individual benefits attributable to those outstanding claims shall be reduced pro rata as necessary to ensure that.

Aggregate limit of liability — an insurance contract provision limiting the maximum liability of an insurer for a series of losses in a given time period—for example, a year or for the entire period of the contract. The aggregate limit of liability is the total amount in dollars that you will be paid by your insurance policy. What does ‘general aggregate’ mean in an insurance policy?

Under the standard commercial general liability (cgl) policy, the general aggregate limit applies to all covered bodily injury (bi) and property damage (pd) (except for injury. What does an aggregate or aggregate limit of liability mean in general liability insurance? The general aggregate limit is spelled out in the insurance contract and caps the number of covered losses for which an insurer will pay.

What does aggregate limit mean? It may be definitive, as in a general lifetime maximum for claims, or it may be set annually (like $500,000 per year). A general aggregate sets the limits of your commercial general liability (cgl) policy.

The aggregate limit is the maximum amount the insurer will pay for all of the liabilities or the series of losses in a given time period. Aggregate limits are a policy feature that meets the needs of both insurance customers and insurance carriers. It is commonly known as an annual limit as the time period is commonly a year.

The aggregate limit is the total amount the insurer will pay in any one policy term. What does aggregate limit mean in insurance? Health insurance plans often carry aggregate limits.

So in the example above, if you have a $1,000,000 per. Most policy periods are one year. An aggregate limit is the highest amount of money an insurer will pay out to settle claims in a given time period.

An aggregate limit is a maximum amount an insurer will reimburse a policyholder for all covered losses during a set time period, usually one year. If unfortunately, you have multiple large claims in one given year, the aggregate limit will be there to help protect you. (1) a limit in an insurance policy stipulating the most it will pay for all covered losses sustained during a specified period, usually a year.

Insurance policies typically set caps on both. The policy contract defines your coverage limits, parameters, and policy period. If you face modest risks and have a limited budget, purchasing a policy with lower limits will keep you safe.

In insurance terms, aggregate refers to the limit a policy will pay during a specified timeframe. What does aggregate limit mean? Aggregate limits are commonly included in liability policies.

The aggregate limit of liability is the total amount in dollars that you will be paid by your insurance policy. Aggregate also is referred to as an aggregate limit or general aggregate limit. For example, if an insurance company has agreed to pay all of a person's medical bills up to $100,000 and the person incurs $135,000 in services, the policyholder must pay $35,000 out of pocket.

Health insurance plans often carry aggregate limits. An aggregate limit is a maximum amount an insurer will reimburse a policyholder for all covered losses during a set time period, usually one year. When an insurance policy is arranged on an aggregate basis, this means that the limit of indemnity is the total amount that the insurer will pay out over.

Lets Talk About Your General Aggregate Limit - Honig Conte Porrino

What Is An Aggregate Limit Of Indemnity Professionalindemnitycouk

![]()

General Aggregate Limits A Potential Insurance Risk Hiding In Plain Sight - Mycoi

Limit Of Liability - What You Should Know Insurance Dictionary By Lemonade

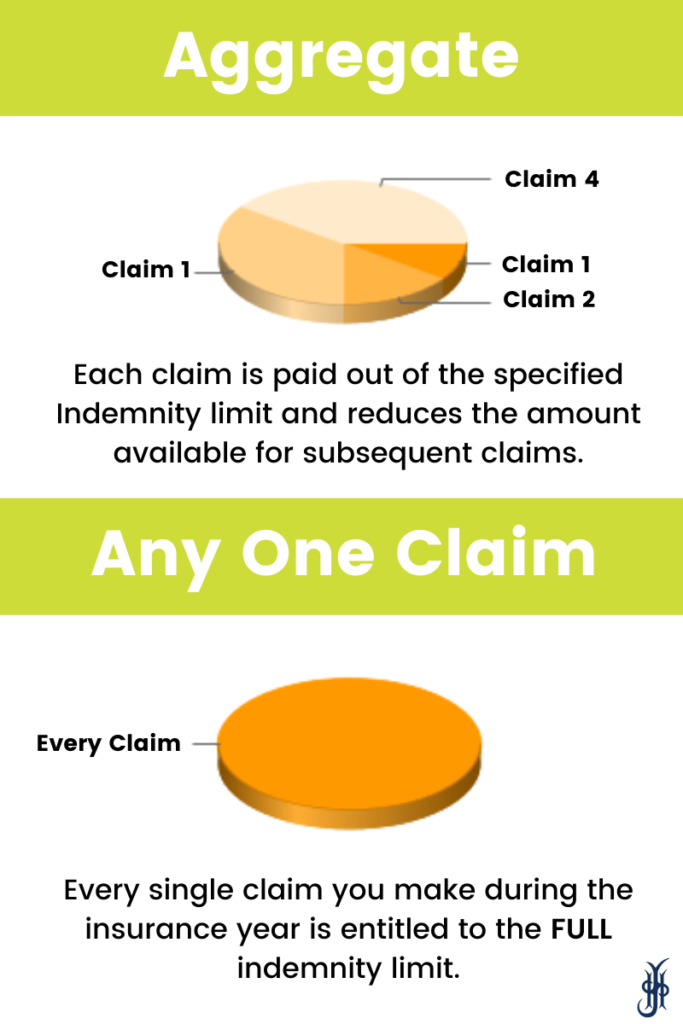

In The Aggregate Vs Any One Claim Whats The Difference Ashburnham Insurance

Asuransi Kesehatan Inner Limit Vs As Charge Mana Lebih Baik Pusatasuransicom

Limit Of Liability - What You Should Know Insurance Dictionary By Lemonade

In The Aggregate Vs Any One Claim Whats The Difference Ashburnham Insurance

Maximum Prices - Definition Diagrams And Examples - Economics Help Diagram Price Maxima

/GettyImages-801982414-3919def938ba436e8a85ade3c6926bb6.jpg)

Aggregate Limit Definition

Pin On Places To Visit

Asuransi Kesehatan Inner Limit Vs As Charge Mana Lebih Baik Pusatasuransicom

What Is A Per Occurrence Limit Bond Glossary Nouns

Aggregate Cover Vs Any One Claims

The Difference Between Per Project Per Location Bcs University

/imitation-of-a-house-in-a-chain-on-a-lock-on-a-gray-piece-of-concrete-on-a-beige-pastel-background--1133455818-33c850555bb14795a46fade3d2e34a17.jpg)

Aggregate Limit Of Liability

What Are Aggregate Limits And Per-occurrence Limits In My General Liability Insurance Policy

Insurance Policy Binder 17 Ideas To Organize Your Own Insurance Policy Binder Life Insurance Policy Workers Compensation Insurance Insurance Policy

What Are Aggregate Limits And Per-occurrence Limits In My General Liability Insurance Policy