You can read our escape of liquid fact sheet for more information. This includes liquid bursting, leaking or overflowing from the appliances, fixtures or plumbing in your house.

Roof Leak Should I Call My Insurance Company Vertec Roofing

Call us to receive a free quote for repairs today.

Leaking roof insurance claim australia. When there’s an insurance claim for a roof leak, an older roof will likely get a smaller payout than a newly installed one. Suncorp’s home and contents insurance will cover you for damage or loss caused by a water leak, or an escape of liquid, if it’s accidental or sudden. Where a claim is made, it falls on the insurer to either settle the claim less the excess or demonstrate the event that caused the damage or the property itself is not covered by the policy.

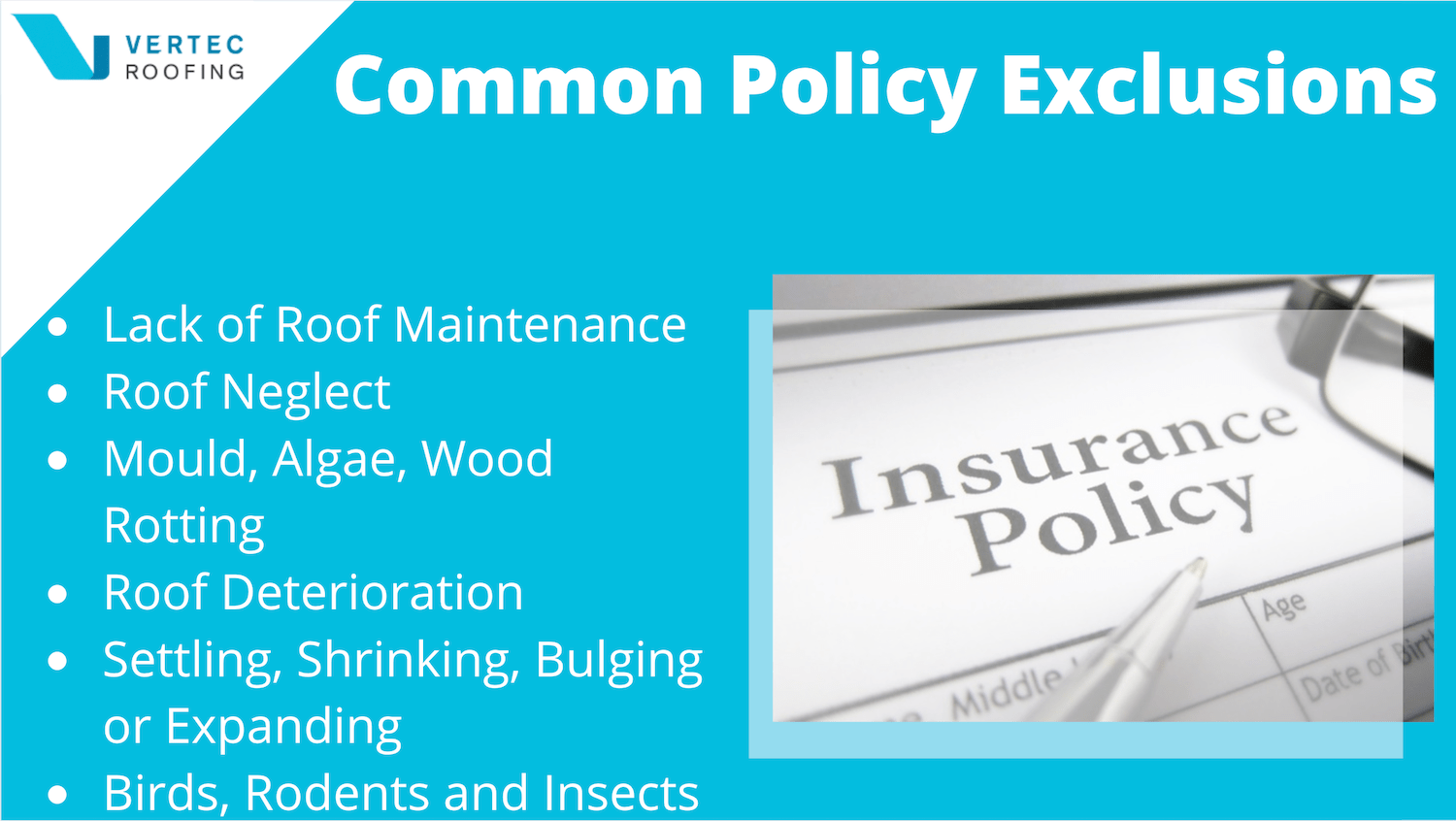

Can i claim for a leaking roof on my home insurance? Water damage, plumbing & roof leak insurance claims call the experts at ocean point claims to help you through the claims process. “however, if your roof was not properly maintained, for example it’s weathered and suffered a leak from deterioration or wear or tear, then your insurance.

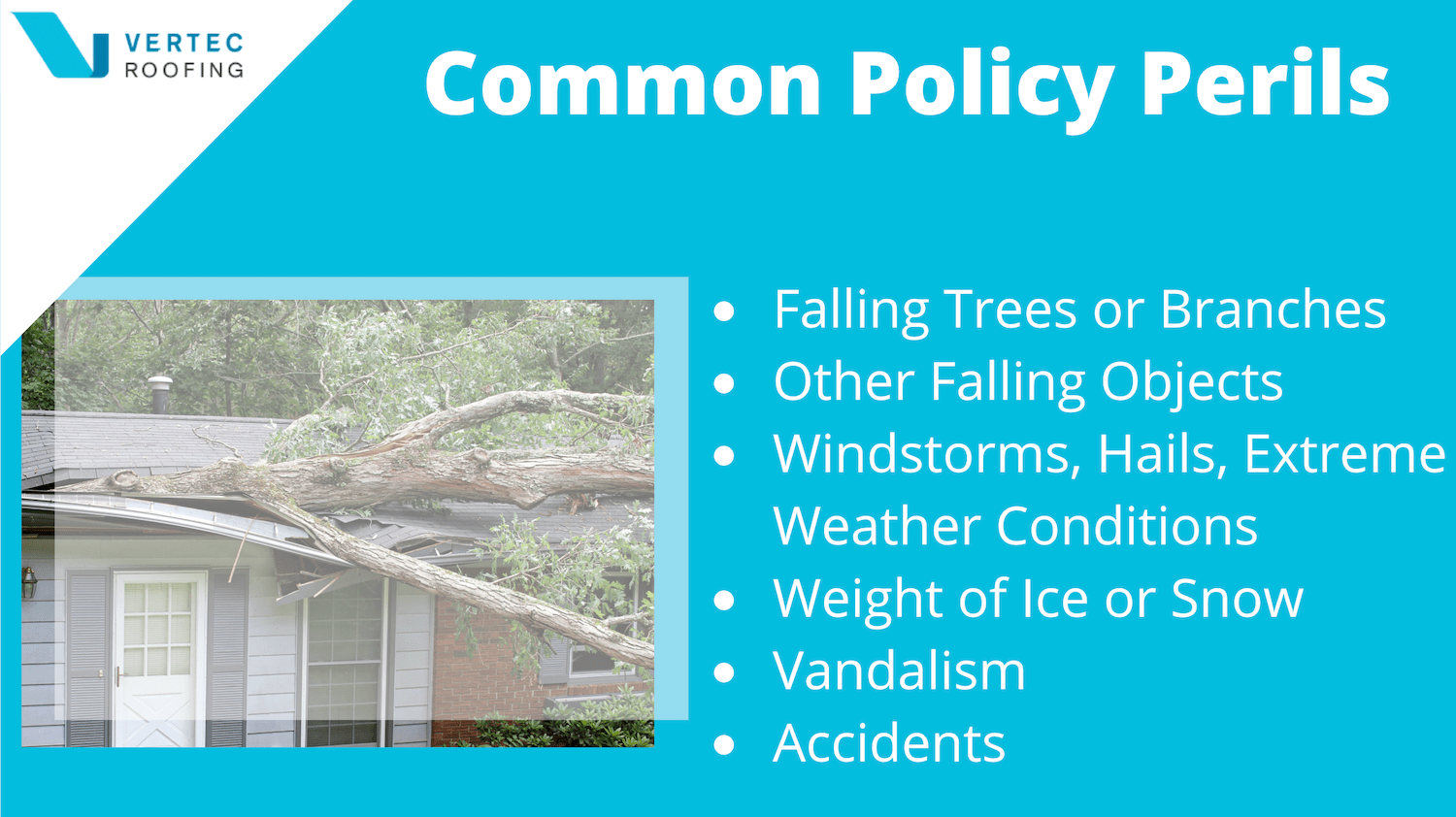

According to one experienced roofing contractor, “insurance companies heavily scrutinize claims for roof repair and replacement. Leaking roof insurance claim in many circumstances, insurance will cover roof damage caused by a leaking roof, especially if it is caused by natural events such as hail storms and fallen branches. On the other hand, if your roof is damaged in a storm, then you should be covered for repairs to the roof, plus internal damage caused by water leaking through.

This is the most common insurance assessment that homeowners get back after they submit a claim for roof repairs In more severe cases ceilings can collapse and water can damage floors, skirting and cabinetry. It's the same with all insurance companies.

If your roof hasn’t been reasonably maintained and this has contributed to the damage you want to claim for, you might not be covered. If you have a leaking or burst pipe that causes damage to your property, your policy provides cover for the costs to locate the leak and any resulting damage caused by it. You can make a leaking roof insurance claim if it's due to circumstances beyond your control, such as a storm or natural disaster.

The answer to this question largely depends on what caused the leak. So, if your roof leaks and you make a claim against the insurance company for repairs, you can expect some resistance for a full ‘payout’. Water damage is fairly common.

Similar to plumbing, your leaky roof won’t be covered by your home insurance if it’s happened because you didn’t do maintenance on your home. If you don't have anything broken (tree fell on the roof tiles etc) insurance companies don't want to pay roof leaks. An example of this is roof damage.

The most common cause of roof leaks are from broken and slipped tiles, flashings not being installed properly, blocked gutters and iron roof screws/seals coming loose. For instance, if your property was hit by a sudden storm which resulted in damage to your roof, most home insurance providers will cover the cost of repairs. Filing a comprehensive claim with an insurance company can be both tedious and exhausting.

Your policy does not cover the cost to repair the leaking/burst pipe. To limit their liability and, ultimately, the amount they have to pay out if something happens to your roof. It’s not designed to cover damage that could be avoided by regular maintenance.

Because they tie it up to lack of maintenance and normal wear and tear. Talk to our experts at hopewell roofing & restoration when deciding whether to file an insurance claim for leaking roof damage. Water damage is often caused by a pipe or pluming leak or burst, water heater leak, air conditioner condensation leak, supply line burst, toilet overflow, roof leak, window leak and needs to be removed immediately.

In the last 12 months, 968 claims were paid worth $2,442,823. We had the same issue with nrma. If you do decide to file a claim with your insurance provider, having a qualified roofer will be a huge advantage.

Home insurance provides cover for unexpected events that are outside of your control. If you’re claiming for damage caused by seals that haven’t been maintained, you might not. Over the year, 703 claims, worth $2,428,960, were paid.

So sorry but i don't like your chances. “if a storm rolls in and damages your roof which also leads to water damage internally, then you may be covered for the repair of the roof and the resultant damage inside your property. How to make a home insurance claim for water damage.

Are you covered and how to claim | canstar. A roofing expert will be able to find the best route for the insurance claim depending on what they find during the roofing inspection. Does home insurance cover a leaking roof?

Roof leak claims are problematic. Leaking roofs in most cases will cause damage to the internal ceilings. Keep in mind that your insurance company has one goal:

If your roof has been leaking for years and is. However, it is unlikely that an insurance company will cover general maintenance items as this is deemed the home owner’s responsibility.

Does Buildings Insurance Cover Roof Repairs Rj Evans

Pin On Independent Insurance Agency

Can You Claim Roofing Insurance Works For Hail Damage Capricorn Roofing

5 Signs Of Roof Damage You Cant Ignore Handyman Tips Roof Damage Roof Maintenance Roof

Can I Claim Roof Repairs On My Insurance Vertec Roofing Sydney

Monitor Your Home After A Storm

Is A Leaking Skylight Covered By Insurance Vertec Roofing

Roof Leak Should I Call My Insurance Company Vertec Roofing

How To Dispute A Roof Damage Insurance Claim Denial

Frustrated Woman Claiming Insurance For Water Leaks Sitting On A Couch In The L Ad Insurance Water Claiming Frustrated Woman A Leaks Women Image

Roofing Adelaide You Get What You Pay For When Hiring A Roofing Contractor In 2021 Roofing Contractors Roof Leak Repair Roofing

Roof Leak Should I Call My Insurance Company Vertec Roofing

Will Insurance Claims Cover Roof Repairs After A Storm

Roof Repairs That Are Covered By Your Insurance Provider - Summit Roofing Services

Can I Claim Roof Repairs On My Insurance Vertec Roofing Sydney

Roof Leak Should I Call My Insurance Company Vertec Roofing

What Roof Repairs Are Covered By Insurance Stormguard Roofing

3 Signs That You Need To Replace Your Asphalt Roof

Claiming Your Damaged Roof On Insurance Roofingcorp