Private premium financing what is private premium financing? We provide premium finance for high net worth clients of life insurance brokers, private banks and wealth managers.

Minimum And Maximum Over-funded Life Insurance Policies Innovative Retirement Strategies Inc

Say you’re a business owner or real estate developer, and your money is earning 20 percent.

Private premium financing life insurance. Some insurance policies require sizable premium payments that can be disruptive to your overall financial strategy. Personal insurance (up to 9 months) private motor vehicles (comprehensive only) home only or home and contents. Premium normally paid for life insurance can continue to be managed in their investment accounts or left in their business.

The information provided here is not investment, tax, or financial advice. Type of loan and how it can be used to purchase a life insurance policy. High net worth individuals will often forgo the purchase or acquisition of needed insurance because.

Allows for dual leveraging and arbitrage opportunity by using the lenders capital to finance life insurance premiums and retain the use of your assets for other investment opportunities. Life insurance is usually bought to provide a death benefit. Who is the best fit for life insurance premium financing?

Back to life insurance premium financing. What is life insurance premium financing? A way to plan for estate taxes.

Holland & knight's life insurance premium finance team leverages more than 60 years of combined legal experience in the private wealth and financial services sectors to efficiently prepare loan structures and quality documentation for its institutional clients, while advising on trust formation, intergenerational planning, insurance policy and collateral matters. The gifts of large premium amounts may Nine annual premium payments of approximately $371k should provide enough premiums to carry the policy for his lifetime.

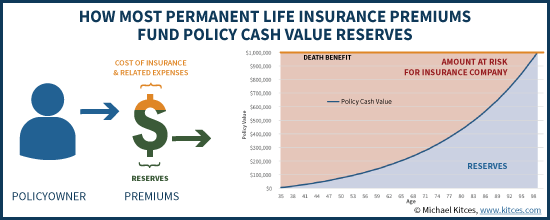

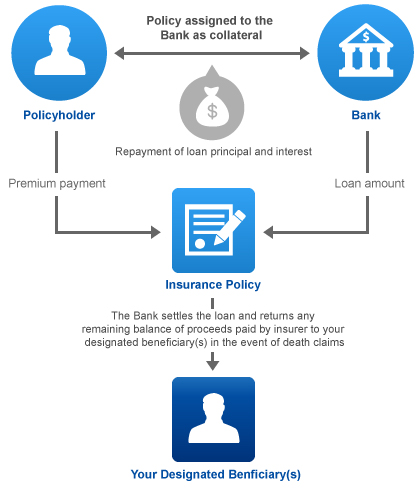

Banks will loan up to 95% of the cash value of a policy in a premium financing transaction. Life insurance premium financing can help you maximize wealth to your heirs and keep your legacy intact. Method of purchasing life insurance by paying the required premiums with borrowed funds from a third party lender.

Premium financing is not the magic solution to every single premium purchase of a life insurance policy. Premium financing for life insurance policies. In a typical ilit, the trust’s “grantor” establishes the trust and then makes cash gifts to fund the purchase of an insurance policy.

A creative solution is to create an irrevocable life insurance trust (ilit) with daughters as the beneficiaries. Learn more about our premium financing plan. Life insurance can play an important role in leaving a lasting legacy for family members.

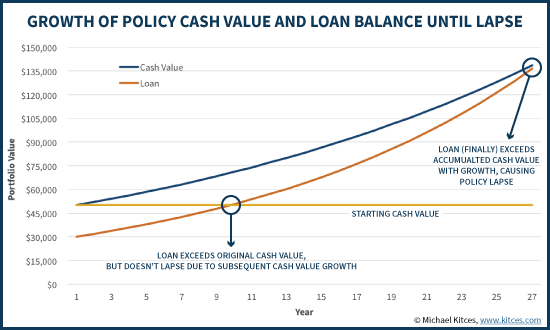

Regardless of the term of the loan, a lender will require the loan to either be repaid or refinanced upon maturity. Life insurance can play an important role in leaving a lasting legacy for family members. Private equity deals or any substantive investment.

Ad don’t delay on getting term life insurance. But there are many lifetime benefits of using the cash value in life insurance policies to help fund your retirement plans. The value of life insurance for estate liquidity, protection planning, business coverage or as an alternative asset class is naturally weighed against the capital or cash flow required to support the premium payments.

Worry less about the future with term life insurance. Some insurance policies require sizable premium payments that can be disruptive to your overall financial strategy. Terms premium financing loans are either annually renewable or fixed for a term of years.

Worry less about the future with term life insurance. Ad don’t delay on getting term life insurance. Premium financing is an insurance concept that allows a buyer of insurance to allow the bank to pay the premiums for them.

Permanent life insurance offers specific benefits that improve the premium financing picture. In this example, the family could use private financing to fund $15m of life insurance owned by the ilit. Private premium financing life insurance.

Private premium financing is the funding of life insurance premiums through a personal loan to an irrevocable life insurance trust (ilit). Private financing of life insurance is a means of transferring wealth from one generation to another. Learn more about our premium financing plan.

Cash Flow Banking With Whole Life Insurance Explained

Life Insurance As A Private Reserve

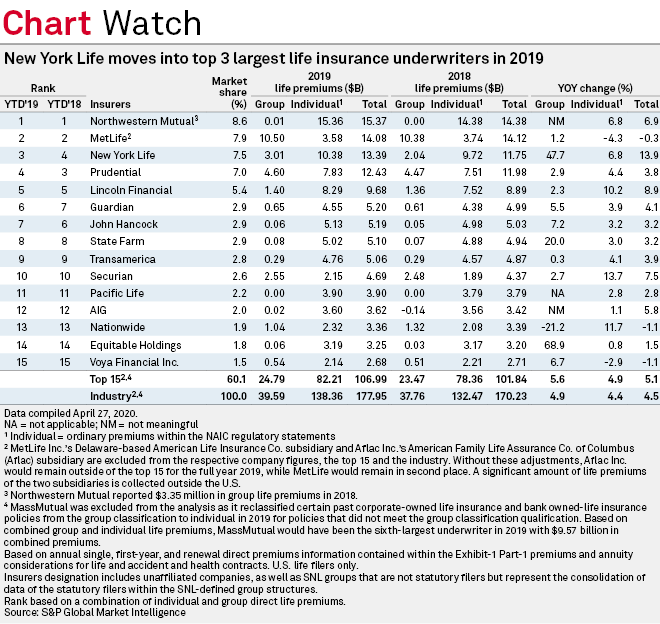

Aggregate Us Life Insurance Premiums Grew By 45 In 2019 Sp Global Market Intelligence

Premium Financing An Option For Disappointed Life Insurance Policyholders

Universal Life Insurance - Not Just A Wealth Protection Plan Magazines - The Business Times

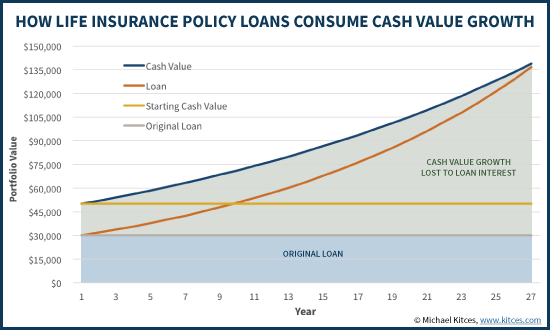

Life Insurance Loans A Risky Way To Bank On Yourself

Private Family Banking System With Whole Life Insurance Paradigm Life

Indexed Universal Life Insurance 2021 Definitive Guide

5 Types Of Private Mortgage Insurance Pmi

Corporate Owned Life Insurance - Overview - Mullin Barens Sanford Financial And Insurance Services Llc

Life Insurance Premium Financing Capital For Life

Pin On Tips For Financing Aging In Place

Life Insurance Loans A Risky Way To Bank On Yourself

Life Insurance Premium Financing Capital For Life

Heirloom Vii - Universal Life Insurance Singapore Dbs Treasures

Life Insurance Premium Financing What You Need To Know

Corporate Owned Life Insurance - Overview - Mullin Barens Sanford Financial And Insurance Services Llc

Life Insurance Loans A Risky Way To Bank On Yourself

Insurance Financing Service Insurance Services - China Construction Bank Asia