Managing the accounts receivable ledger is a separate duty from collecting on invoices. It could mean the difference between profit and loss or even bankruptcy for your business.

Accounts Receivable Management Support Atradius Receivables Management

Accounts receivable insurance coverage is designed to cover losses due to a wide range of commercial and political risks that could result in bad debt.

Accounts receivable insurance canada. Also known as credit insurance or trade credit insurance, it is a valuable tool that helps businesses trade and grow securely. Ars vary in their terms. Ari global, inc., accounts receivable insurance, is a monoline broker specializing in credit insurance.

Bob’s company is based in canada and he sells components to computer chip manufacturers throughout north america. Full benefits, 100% employer paid. Edc credit insurance is a type of commercial export insurance that protects your accounts receivable against losses when a customer cannot pay.

An accounts receivable insurance policy allows companies to feel secure in extending more credit to current customers, or to pursue new, larger customers that would have otherwise seemed too risky. Bank deposits and cash receipts. Insurance bureau of canada and insurance information institute).

Since our inception, we have been consistently recognized as an elite broker/preferred broker with the major carriers. Premium rates for accounts receivable insurance are based on the terms you extend, the spread of your buyer and industry risks, and your company’s previous credit and collections experience. It allows your company to:

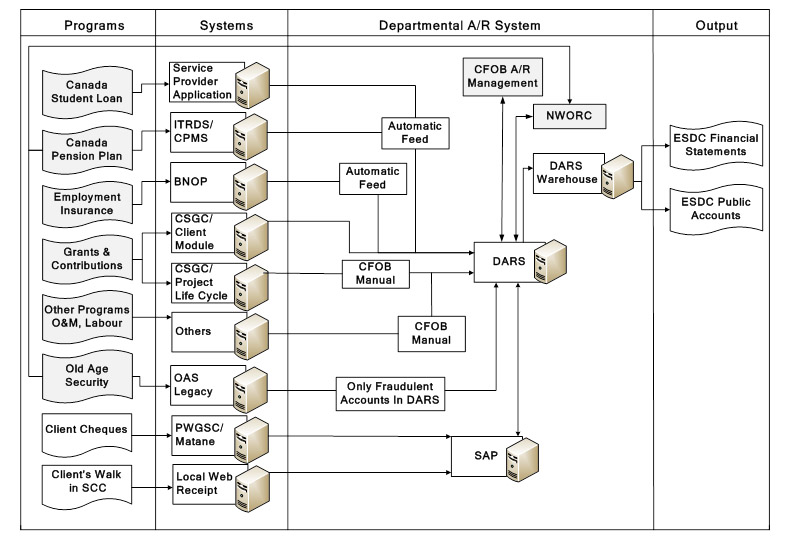

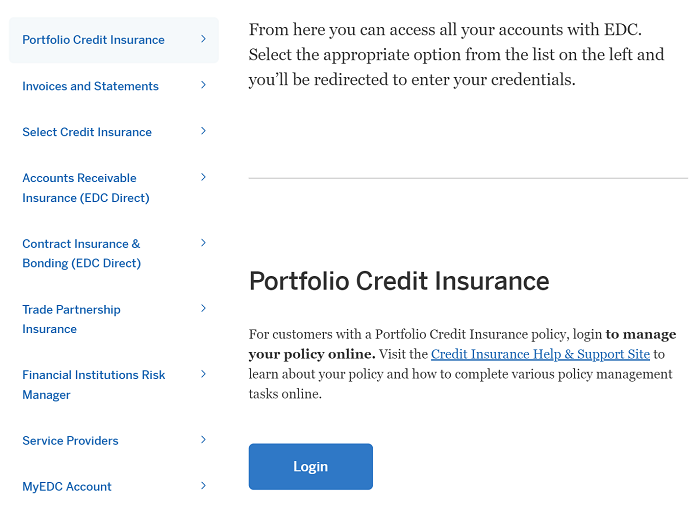

The nar group is responsible for many aspects of the management of a/r through three national a/r sites based in moncton, toronto, and the national capital region. Such unforeseen trade disruptions can be caused by buyer insolvency, protracted default (failure to meet obligations on time due to inadequate cash flow), or political disruptions that lead to a loss on current receivables. The accounts receivable ledger is a record of all trade credit sales made by a business.

Ar accumulates when you provide a good or service that your customer hasn’t paid for yet. Accounts receivable analysis and reporting. This type of coverage is.

The insurance industry is thriving. In 2016, home, car and business insurance sales reached $533 billion in the united states and just over $53 billion in canada (source: Employing the professional services and advice of a trusted independent insurance agent can make the buying process smooth and worthwhile, and can ensure that your business has the exact coverage that you need.

It is essentially a line of credit as they receive your product before paying. 2.3 accounts receivable centers’ activities could be strengthened by standardizing and documenting key processes cash receipts and deposits. The protection it provides allows a company to increase sales to grow their business.

The receivables insurance association of canada (riac) has developed the only accredited suite of receivables insurance training in canada to help brokers, bankers and business owners better understand receivables insurance. We offer the protection you need now and in the future. So it is critical for insurance companies to maximize.

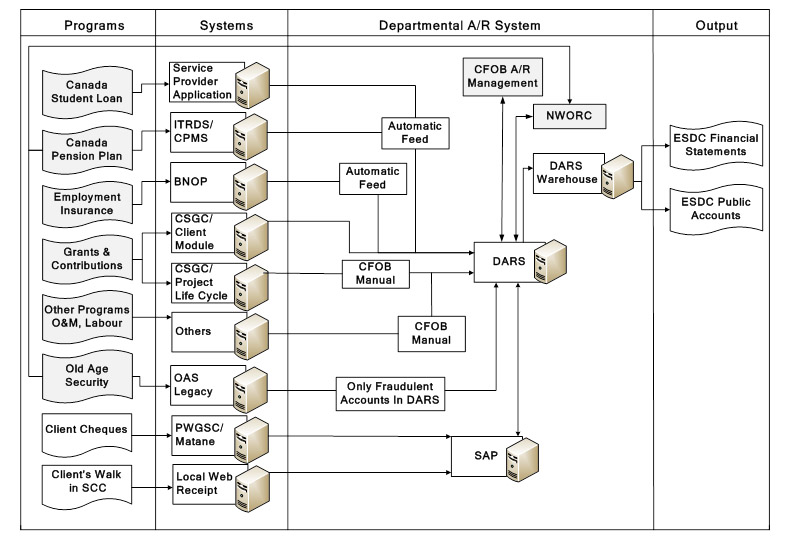

Expand your market to buyers or developing markets that would otherwise be considered too risky. Accounts receivable insurance (edc direct) for customers with an accounts receivable insurance policy, login to edc direct to access the receivables insurance centre to manage your policy online and view your invoices and statements. Because the ledger records all customer invoice amounts, it provides a clear look at the amount of unpaid accounts receivable.

Accounts receivable insurance protects a company’s accounts receivable by covering loss that arises from a customers’ default, insolvency, or bankruptcy, as. Accounts receivable (ar) insurance offers many additional benefits. With accounts receivable insurance acting as a second source of repayment, a company can assure a lender it will not have covenant issues if there is default by a customer.

Credit insurance is an easy way to safeguard your companys profit margin. Accounts receivable insurance could play an important part in your business insurance and risk management program. Accounts receivable (also referred to as ar) is money that customers still owe to your business.

Accounts receivable in the insurance industry. The cost of receivables insurance is low, typically a small fraction of one percent of your covered sales volume. Accounts receivable insurance is insurance protection against the possibility of events taking place that render it impossible to collect on payments owed to the business.

The audit reviewed key processes for cash receipts and deposits, bank reconciliations, credit. Accounts receivable insurance protects a company against financial losses caused by damage to its accounts receivable (ar) records. Reduce bad debt reserves, freeing capital for investment.

Accounts Receivable - Canadaca

Accounts Receivable Ar Insurance For Small Businesses - Aon Canada

Why Should Canadian Smes Leverage Trade Credit Insurance Post Covid-19

Apply For Insurance Edc

2

What Is Accounts Receivable - Loans Canada

Medical Accounts Receivable Services And Solutions

Credit Management Options Comparison Euler Hermes Japan

7 Cash And Receivables After Studying This Chapter You Should Be Able To Understand Cash And Accounts Receivable From A Business Perspective Define - Ppt Download

Apply For Insurance Edc

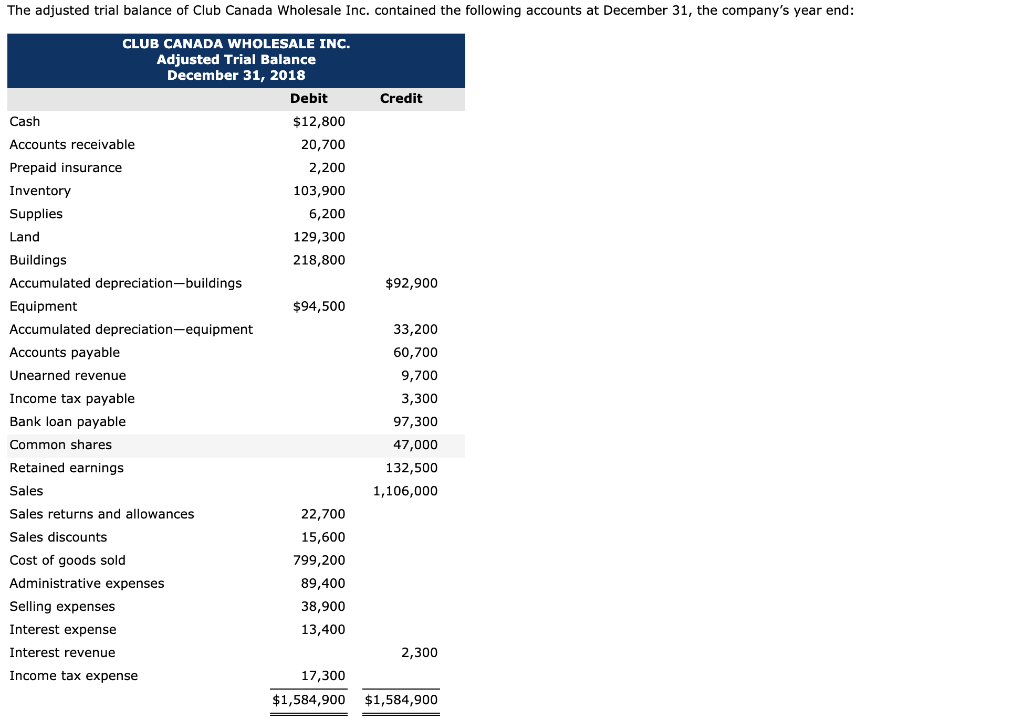

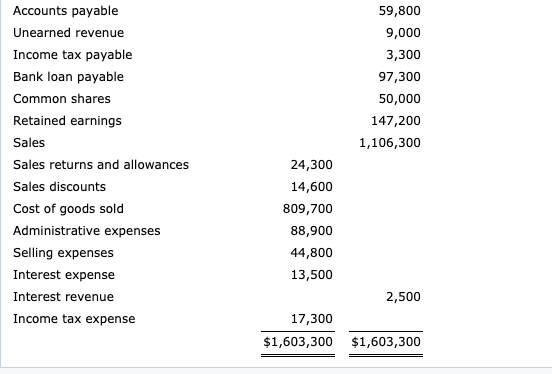

Solved The Adjusted Trial Balance Of Club Canada Wholesale Cheggcom

Accounts Receivable - Canadaca

Why Should Canadian Smes Leverage Trade Credit Insurance Post Covid-19

About Riac Receivables Insurance Canada

Insurance Billing And Account Receivable Services Usa

Audit Of Accounts Receivable Management At Health Canada - Canadaca

Accounts Receivable Insurance Definition Costs Euler Hermes Usa

Solved The Adjusted Trial Balance Of Club Canada Wholesale Cheggcom

Why Should Canadian Smes Leverage Trade Credit Insurance Post Covid-19