Life insurance and ltd should cover all the needs that an add policy would. Medicare advantage plans also tend to have more limited provider networks.

Accidental Death And Dismemberment Add Insurance

Supplemental employee life rates vary by the specific type of insurance coverage offered (e.g., term, permanent, or ad&d), your age, where you live, the size of the group, and your benefit amount.

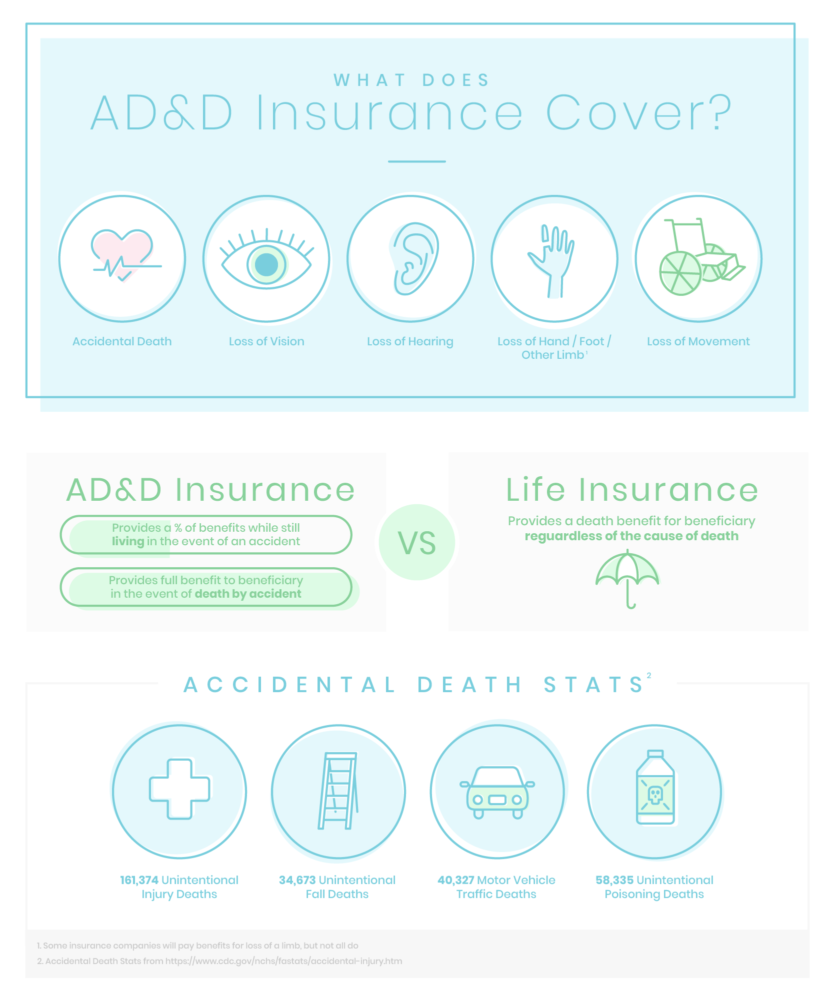

Supplemental ad&d insurance worth it. Supplemental policies for the others in your life may be just as important. Accidental death and dismemberment insurance, also called ad&d insurance or accidental death insurance is a type of insurance that pays out a benefit if you are injured or killed in certain accidents. Ad&d coverage could be a wise investment regardless, but understand that ad&d doesn’t cover you for any type of death or dismemberment.20 мая 2020 г.

Turns out there was also a benefit of 2% of the value per month. If you get this coverage for free or your emergency fund is not fully funded then it's worth getting. Should i get ad&d or should i look into a life insurance policy?

Accident coverage is a component of ad&d insurance, but you can also purchase a standalone policy with less restrictions. Pros and cons of accidental death and dismemberment insurance What would happen if your loved one died?

Insurance is all about transferring risk. Supplemental insurance is less complicated with the exception of dental or vision plans ,you wont have to worry about things like coinsurance, deductibles, copays or. Supplemental life insurance through your employer

Yes, it pays a death benefit, but as the name suggests, only provides coverage in the event you die due to an accident. Some people use ad&d as an alternative to life insurance. You might and not even realize it.

However, these policies often have some exclusions. For example, monthly premiums might start at $4.50 for every $100,000 in accidental death coverage from farmers. Given that illness is the major cause of disability, a disability policy is likely to apply to more situations than an ad&d policy.

Is supplemental ad&d worth it? It also offers a benefit for a serious injury caused by an accident that. The closest alternative to accident insurance is accidental death and dismemberment (ad&d) insurance.

However, an ad&d policy is pretty useless if you pass away due to an illness or chronic condition, which statistically is more likely. This is a type of policy that pays a benefit if you die or lose a limb in an accident. But before offering ad&d coverage, it’s important to understand what ad&d covers and what it doesn’t.

The policy’s death benefit is paid if death is caused by an accident, such as a car crash, fall, or murder. Accidental death and dismemberment insurance provides coverage if an insured is the victim of an accident that causes death, dismemberment or serious disability. Accidental death and dismemberment (ad&d) insurance gives your employees added financial security in sudden and tragic circumstances.

If the employee is on the road extensively or spends half their time flying coast to coast, it may be worth looking into a supplemental ad&d policy. This ad&d premium was very inexpensive through payroll deduction. It’s an optional benefit offered by employers.

With my limited knowledge of insurance, i would assume ad&d would be just as good as life insurance (since i am not married). Supplemental life and burial insurance Supplemental ad&d can play a critical role, but it's wise to think of it as added protection rather than solely relying on ad&d coverage.

My employer offers accidental death and dismemberment (ad&d) insurance and life insurance. Think of ad&d insurance as a supplemental policy to your life and disability insurance policies. Most people know about supplemental life and ad&d (accident, death, and dismemberment insurance) but forget about supplement life insurance for a spouse or child.

If you can afford to take the risk, you don’t need to pay for insurance to protect you. Just balance the monthly cost against. Typically, metlife’s ad&d policies pay out a lump sum.

It’s less expensive than traditional life insurance and does not require underwriting. Also known as “personal accident insurance” or “supplemental accident. But, still, if a limited supplemental life insurance policy is pretty expensive, it may not be worth it.

Supplemental insurance for medical issues. Rates start at $6 a month for $100,000 of coverage from fabric and rise to $30 a. Supplemental insurance works a little differently than a regular health plan, and thats a good thing.;you still pay a monthly premium , and supplemental plans still provide payments via claims.

However, the cost of group life insurance purchased through your company will typically be lower than a supplemental insurance policy purchased as an. Ad&d insurance is generally inexpensive, and it’s common for employers to offer a small policy to their employees as an alternative to life insurance. Ad&d insurance is generally inexpensive, and it’s common for employers to offer a small policy to their employees as an alternative to life insurance.

Supplemental ad&d insurance, sometimes offered alone or as a supplement to other life insurance programs, provides additional money to your beneficiaries in the event you die or become dismembered in an accident.

8 Common Group Insurance Myths And Misconceptions Debunked

Add Insurance

Healthcare Video For Undisclosed Client On Vimeo Healthcare Videos Motion Design Motion Graphics

Term Life Vs Whole Life Insurance My Insurance Fairy Terminsurance Life Insurance Policy Life Insurance Cost Term Life

12 Ways To Save On Term Life Insurance Insurancecom Term Life Life Insurance Policy Insurance Marketing

Voluntary Life Insurance Quickquote

What To Know About Add Insurance Forbes Advisor

Should I Buy Group And Supplemental Life Insurance - Valuepenguin

Automobile Liability Insurance Buy Health Insurance Life Insurance Policy Getting Car Insurance

Accidental Death And Dismemberment Insurance What Does Add Insurance Cover Desirepaul Network

What Is Add Insurance - Video Library

Automobile Liability Insurance Buy Health Insurance Life Insurance Policy Getting Car Insurance

What Is Add Insurance - Jeanne-m

Lifeinsurance Classifications Or Categories Will Vary Slightly By Insurer But In Many Cases There Is Some S Life Insurance Insurance Life Insurance Companies

Term Life Insurance Policygenius

Add Insurance

Life Insurance Plans American Fidelity

The 5 Best Add Insurance Providers Termlife2go

Accidental Death Insurance The 4 Absolute Best Policies