Motor carrier liability insurance includes a wide variety and types of coverage. (a) if the motor carrier is subject to motor carrier insurance requirements and meets them by a means other than auto liability insurance.

Truck Insurance Coverage Claim Lawyer Warriors For Justice

The motor carrier coverage form replaces the old iso truckers coverage form.

Motor carrier insurance policy. 15 or fewer passengers $1.5 million of insurance is required for motor carriers with 15 or fewer passengers (including the driver) if the carrier travels between states or countries. A carrier of certain hazardous materials must have insurance or a bond in the amount of $5 million dollars in liability coverage. Liability insurance coverages for motor carriers includes bodily injury insurance and property damage coverage.

A motor carrier transporting oil must have an insurance policy in place in the amount of $1 million dollars. We can help you be proactive and prepared with your insurance coverage. Additional insurance, such as the umbrella policy mentioned above, can be purchased separately.

When you’re on the road, the last thing you want to worry about is whether or not you’re properly protected. As a motor carrier, you are responsible for getting goods from point a to point b. The carrier has 30 days to acknowledge the claim and must respond within 120 days;

Your local independent agent will work with you to discuss your needs and find the coverages that are right for you. (1) any motor carrier for hire or his or her agents or employees, other than you and your employees: Mandatory motor carrier truck insurance coverages.

Or form l uniform notice of cancellation of motor carrier surety bond intrastate cargo insurance requirements the. Optional motor carrier insurance coverages The latter is no longer relevant as it contains outdated language.

Form k uniform notice of cancellation to motor carrier insurance policies; An insurer must give the agency not less than ten (10) days’ notice of the cancellation of motor carrier bodily injury and property damage liability insurance, or motor carrier cargo insurance by filing: Motor carrier insurance policy september 30, 2021 post a comment 5 million of insurance is required for motor carriers with 16 or more passengers including the driv…

You’ll need to choose what your coverage amounts will be and your deductible amounts. A carrier of passengers with a seating capacity of more than 15 must have $5 million dollars in insurance. How does the new form change the definition of “insured”?

The required filings vary, based on the types of registrations involved. Liability insurance is a mandatory motor carrier insurance coverage that pays for damages you cause to other people and their property. In exchange for an initial payment, known as the premium, the insurer promises to pay for loss caused by perils covered under the policy language.

A motor carrier with at least three years of clean experience can expect to pay between $6,000 and $10,000 per truck. We offer insurance for that. You must provide proof of value and proof of loss

The iso’s new motor carrier coverage form (new form) has required several changes in insurance policies as new policies are being written. Some common questions about the new form are answered below in as simple language as i can make it. A motor carrier that just earned its authority can expect to pay between $10,000 and $12,000 for at least its first year.

What’s an average motor carrier insurance quote? Motor carrier insurance for new authorities is currently around $12,000 a year for a policy with a liability of $1,000,000 and a cargo policy of $100,000. $5 million of insurance is required for motor carriers with 16 or more passengers (including the driver) if the carrier goes between states or countries.

The motor carrier coverage form is an iso form similar to the business auto policy. You must prove carrier negligence (the freight was picked up in good order and packaged properly, but was delivered in a damaged condition) if the shipment is covered by shippers’ interest cargo insurance: Mc1612 m 06/21 mcs90b endorsement for motor carrier policies of insurance for public liability under section 18 of the bus regulatory reform act of 1982 ak , al , ar , az , ca , co , ct , dc , de , fd , fl , ga , hi , ia , id , il , in , ks , ky , la , ma , md , me , mi , mn , mo , ms , mt , nc , nd , ne , nh , nj , nm , nv , ny , oh ,

In insurance, the insurance policy is a contract (generally a standard form contract) between the insurer and the policyholder, which determines the claims which the insurer is legally required to pay. Liability for bodily injury to others It is designed for businesses that haul goods on behalf of others in exchange for a fee.

(b) if the motor carrier is. Where the cargo is being picked up and transported to, types of cargo hauled, average load value, claims history and more.

Sample Truck Insurance Price Quotes

Commercial Truck Insurance Requirements What Coverage You Need

Texas Insurance Requirements For Truck Drivers And Trucking Companies

Commercial Truck Insurance National Independent Truckers Insurance Company

300 Gambar Password Keamanan Gratis

What Owner Operators Need To Know About Commercial Truck Insurance - Truckstopcom

Owner Operator Lease Agreement Template For Pdf And Doc Lease Agreement Workers Compensation Insurance Agreement

What Is Non Trucking Liability Insurance

What Type Of Insurance Do You Need As A Commercial Trucking Company - Otterstedt

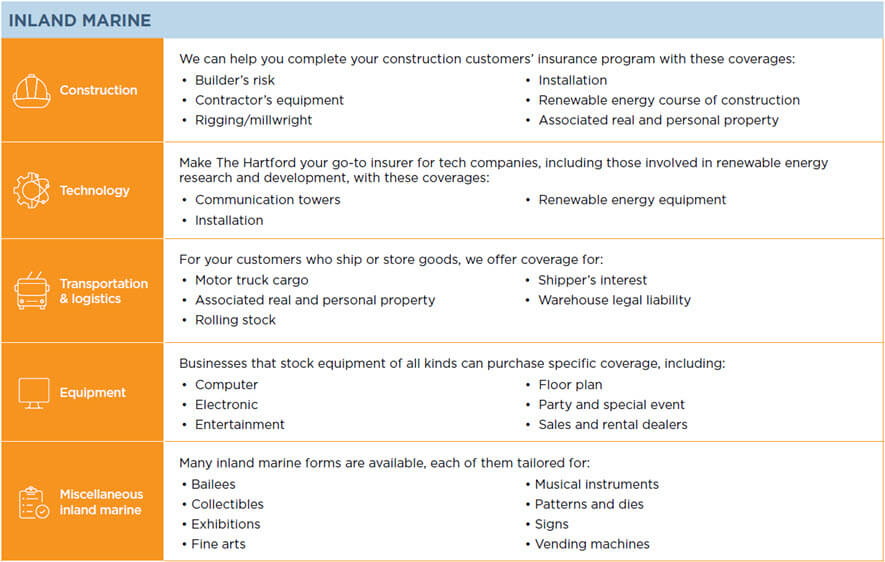

Carrier Logistics Choice Business Insurance The Hartford

Amazon Relay Insurance Requirements Jdw Commercial Truck Insurance

Commercial Truck Insurance For New Drivers - Get A Quote

Understanding Motor Truck Cargo Liability Coverage - American Team Managers Insurance Services

Commercial Vehicle Insurance Coverage Claim Renewal

Freight Cargo Insurance Policy Types Explained

What Is Motor Truck Cargo Coverage Advisorsmith

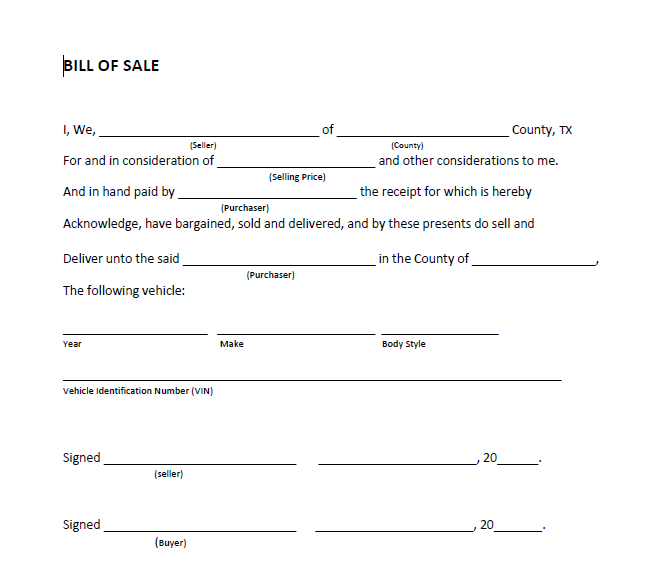

Why A Truck Insurance Company Will Ask For A Bill Of Sale To Remove A Heavy Truck - Bound Insurance

Sample Truck Insurance Price Quotes

What Is The Minimum Insurance I Need To Get My Truck Operating Authority