The beneficiary designation was forged, If you are facing this situation and are wondering if you should file a dispute, here’s what you need to know.

Is Life Insurance Taxable In Canada Canada Protection Plan

However, a probate court could be petitioned, if the owner of the policy was mentally incapacitated when the beneficiary was designated.

Can you contest life insurance beneficiary canada. If you find yourself in a situation where your designation as the beneficiary is being contested or would like to dispute the designation on your loved one’s policy, our attorneys are here to help. Articles | january 9, 2019. The other parent is usually the beneficiary in trust for the child or children.

That means that a life insurance beneficiary designation can be contested. Other times it has to do with child support issues. While the case is in dispute, the life insurance companies place the payout in a trust held by a state court.

Common times people dispute life insurance beneficiaries. Can a life insurance beneficiary be contested? It can be extremely difficult to challenge the validity of this contract.

As a result, creditors can not claim against the funds from the policy. The simple answer is yes. If you think that you should be a life insurance beneficiary, and you are not, you can contest the designation and there are multiple grounds for doing so.

This can cause the current spouse and any children from the second marriage to dispute the beneficiary designation on the policy. The supreme court of canada extended the circumstances where an irrevocable beneficiary designation made in a life insurance policy can be challenged after the death of the policy holder. Contesting life insurance beneficiaries is a legal process but whether your dispute is subject to state or federal law can depend on the policy.

Contesting a life insurance policy in canada is not an easy task. In the meantime, “the estate stays open and fees accrue and taxes. One common scenario in which people want to contest a life.

Affordable, flexible term life insurance at your pace. Any person with a valid legal claim can contest a life insurance policy's beneficiary after the death of the insured. However, if you can show that the deceased neglected to update the.

That means that there isn’t a court supervising the distribution of proceeds. Individuals may seek to contest a beneficiary designation on an ira, life insurance policy, or other account for any number of reasons. This article will explain those grounds.

The final decision rests in the hands of the courts, not in those of the insurance companies. A life insurance policy is not subject to probate. This is the easiest and most straightforward way in which to contest the life insurance beneficiary designation.

If you have named your estate as beneficiary, then this money is fair game for creditors once it is paid. A life insurance policy is a contract in which an insurance company agrees to pay the proceeds of a policy to a named beneficiary upon the insured’s death. It's more difficult to contest a life insurance beneficiary than a will, because life insurance doesn't go through probate.

Life insurance beneficiary disputes can drag on and become costly. Affordable, flexible term life insurance at your pace. Many people purchase life insurance when they.

Contesting life insurance beneficiary canada. Overall beneficiaries have not had to deal with their desigantion as beneficiary to an insurance policy being contested. If, for example, the life insurance policy was issued by an employer and is covered by erisa guidelines then federal law would apply when disputing a beneficiary.

A life insurance beneficiary is a person or entity you designate to receive your life insurance death benefit should you pass away. It is extremely difficult to contest a life insurance beneficiary. Often, someone who believes they were the policy's rightful beneficiary is the one to initiate such a dispute.

A beneficiary is the person who will get a payment from your insurance policy after you die. The facts underlying moore v. It can consume a lot of time, energy and money.

Grounds for contesting a life insurance beneficiary. Yes, you can contest a life insurance beneficiary designation and you may be able to sue for life insurance proceeds. But, there are cases where this has been done and there have been valid grounds for doing so.

Contesting life insurance beneficiary canada. If you have a named beneficiary on your life insurance, the money that is paid out from the life insurance policy never becomes part of your estate. Sometimes family members contest a beneficiary when they feel it was an error for that person to be named beneficiary.

Assigning a beneficiary to your life insurance policy gives you control over your investment, and ensures that in the event of your passing, your beneficiaries are financially supported by your death benefit. Contesting a beneficiary designation is a complex and difficult process. Contesting a life insurance beneficary in alberta canada.contesting a life insurance beneficiary is not an inheritance you want to leave your loved ones.contesting a life insurance policy in canada is not an easy task.

Common reasons to dispute a life insurance beneficiary designation include: If you don’t remove your former partner as a beneficiary, he or. Supreme court of canada revokes an ‘irrevocable’ life insurance designation for beneficiary.

Update your life insurance beneficiaries. Some individuals will contest a beneficiary because they think a fraud has been committed. Contesting a life insurance beneficiary is difficult and may result in a legal battle.

And it's simply difficult for someone to challenge a life insurance policy contract.

![]()

Best Life Insurance Companies In Canada 2021 Guide Protect Your Wealth

Family Insurance Life Insurance In Bc Ab Sk

Sun Life Insurance - Do They Have Everything Under The Sun For You Life Insurance Facts Life Insurance Quotes Best Life Insurance Companies

Best Life Insurance Canada 2021 Company Reviews Top 10

In Mortgage Term Insurance Quotes You Can Designate Who You Want As Beneficiary And They Will Life Insurance Quotes Content Insurance Life Insurance Calculator

Money Therapy - Do You Need Life Insurance Life Insurance Family Life Insurance Life Insurance Quotes

Term Life Insurance In Canada Everything You Need To Know Policyme

Axis Capital Tips For First-time Life Insurance Buyers Life Axis Tips

10 Interesting Life Insurance Facts Emmaca

![]()

Best Life Insurance Companies In Canada 2021 Guide Protect Your Wealth

![]()

Best Life Insurance Companies In Canada 2021 Guide Protect Your Wealth

Compare The Life Insurance Facts And Choose The Best Quotes For Your Family Importance Of Life I Life Insurance Facts Be Yourself Quotes Life Insurance Quotes

![]()

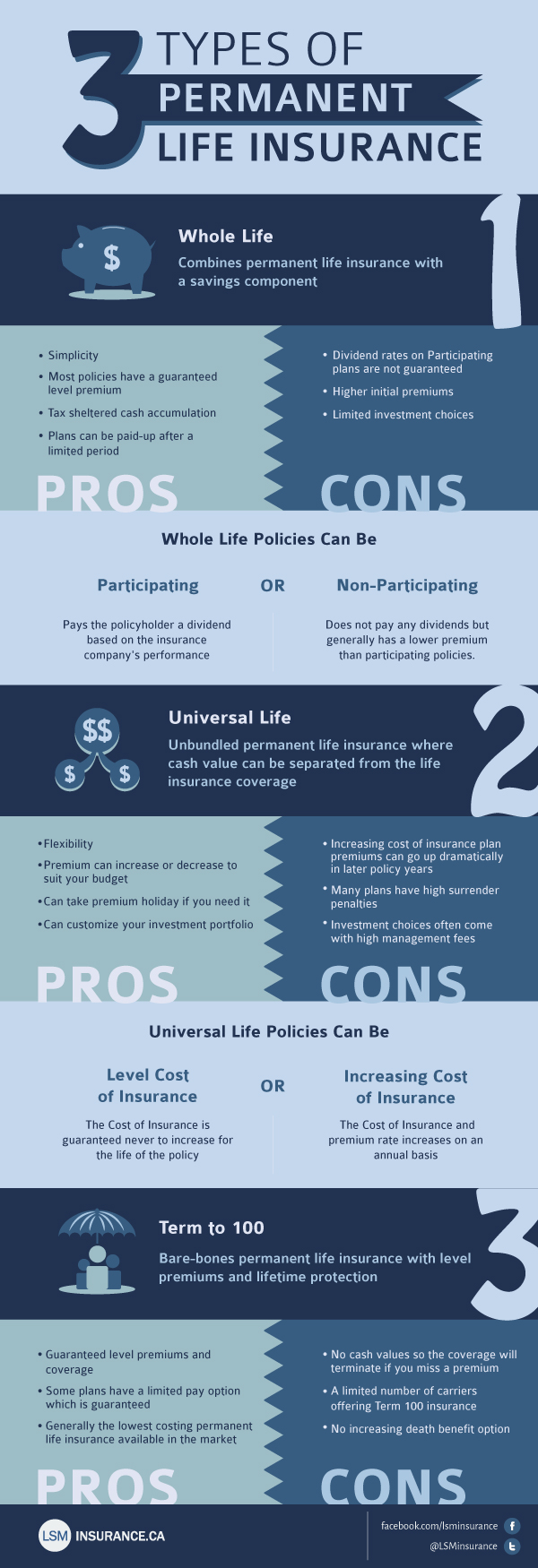

Permanent Life Insurance Universal Life Vs Whole Life 2021 Protect Your Wealth

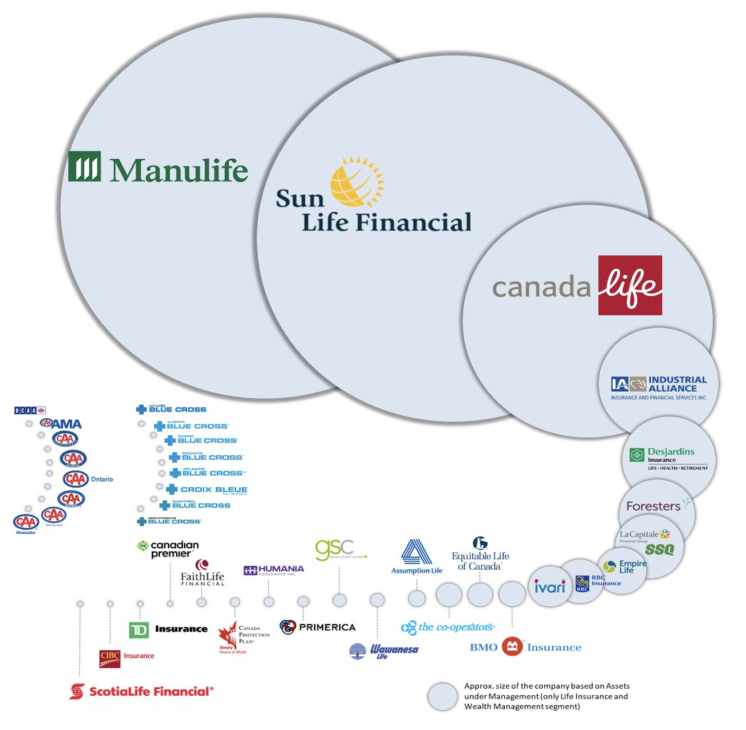

Life Insurance Companies In Canada Full 2020 List

The Types Of Permanent Life Insurance Life Insurance Canada

What Is Life Insurance And How Does It Work Aha Life Insurance Canada

.jpg)

Guide To Life Insurance For Couples In Canada Policyme

Does Life Insurance In Canada Require A Credit Check Credit Score Creditcardgenius

Posgj5k2qkkqum