Because of this, there are tax implications for. Taxation of imputed income i mputed income, once neatly defined as a flow of satisfaction' from goods owned and used by the taxpayer or from benefits arising through the exertions of the taxpayer on his own behalf,' is generally deemed not within the ambit of.

Coolest Resource For Musicians Since Youtube Httpwwwjammobcom Favorite Music My Love

Employees are automatically enrolled in the flextra program for their health benefits, including basic life insurance which is one times the employee's base annual salary, with a minimum of $20,000.

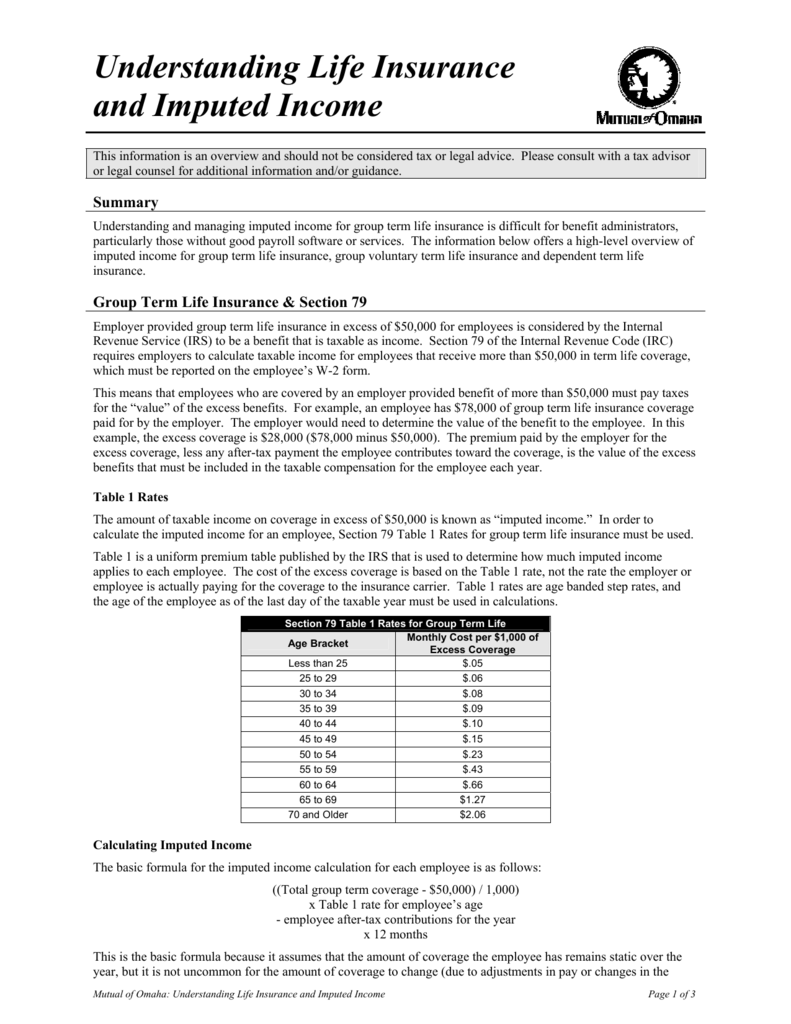

Imputed taxable income life insurance. Basically, imputed income is the value of any benefits or services provided to an employee. The taxable value of this life insurance coverage is called “imputed income.” please refer to irs publication 15‐b, “employer’s tax guide to fringe benefits” and the irs tax table when determining the taxable amount to include on an employee’s w2. $0.06 x 50 = $3.

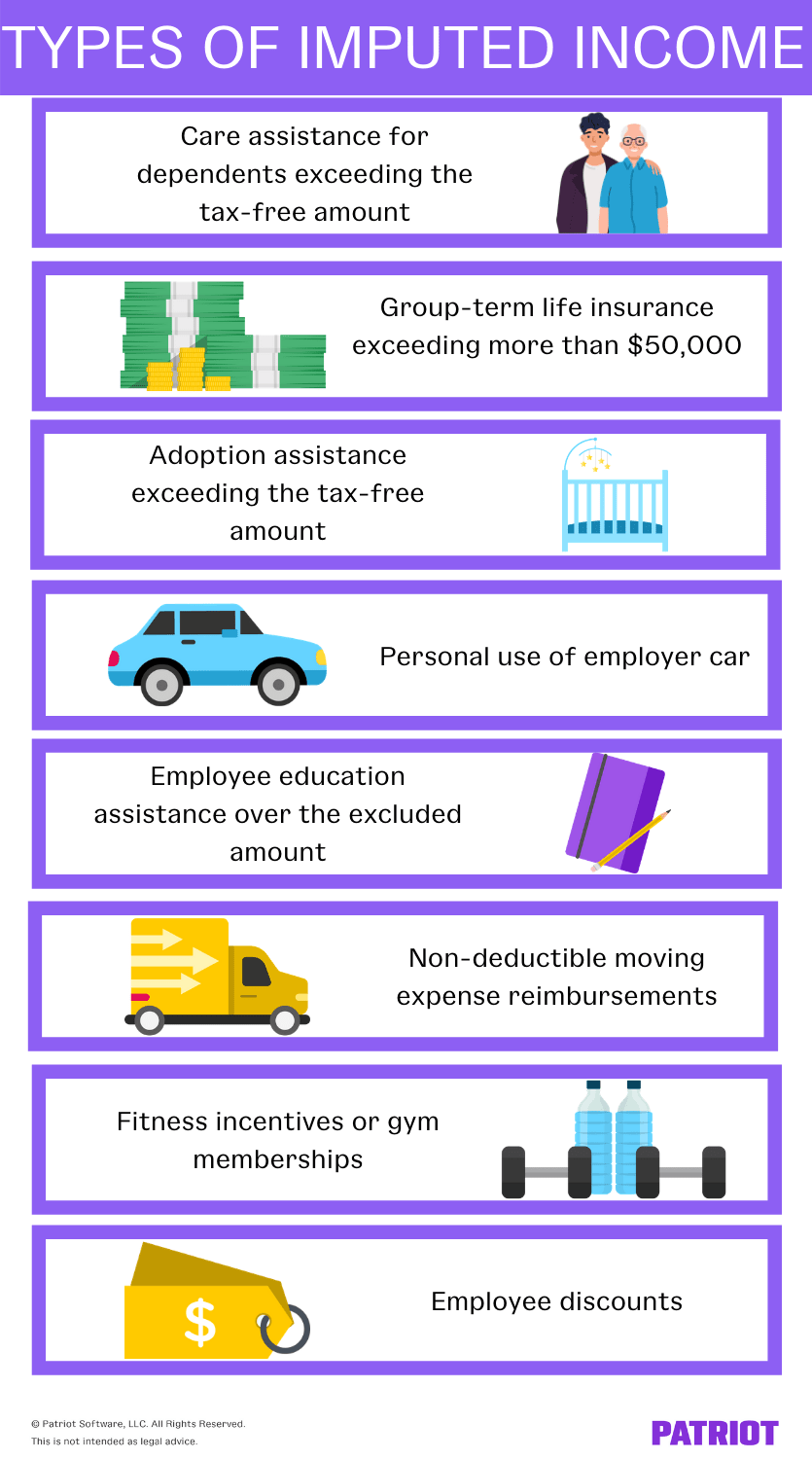

These processes increase the taxable i50 income for many employees (it appears as taxable life insurance i50 income once a month on your pay stub). Excess life insurance applies only to employees who are enrolled in. Gym memberships and similar fitness incentives

$3 x 12 = $36.00. Taxable group life insurance is calculated as follows: Imputed income, for group term life insurance, is calculated using a uniform government table (see below) that provides rates for each age group.

Now, let’s find charlotte’s taxable income. Ad affordable, flexible term life insurance at your pace. The mcps life insurance program and whose salary is above $25,000.

The employer pays any cost of the life insurance, or coverage for spouse and dependents whether a benefit provided is considered de minimis depends on all the facts and circumstances. The employee’s life insurance benefit is $114,000. The payroll deduction report in autoenroll includes an imputed income.

Imputed income the irs considers the value of group term life insurance in excess of $50,000 as income to an employee. Employee educational assistance over $5,250; Then, multiply by 12 to find his annual taxable income.

This concept is known as “imputed income.” even though you do not receive cash, you are taxed as if you received cash in an amount equal to the taxable value of the coverage in. William’s annual taxable income for insurance is $36.00. $90,000 is included in income.

Imputed income is essentially benefits that employees receive that aren’t a part of their salary or wages. So the employee may not have to pay for these particular benefits, but they are responsible for paying the tax on their value. Even though you do not receive cash, you are taxed as if you received cash in an amount equal to the taxable value of the coverage in excess of $50,000.

If the optional policy were not considered carried by the employer, none of the $100,000 coverage would be included in income. The irs considers the amount above a $50,000 group term life insurance death payout to be a form of imputed income. Imputed income typically includes fringe benefits.

Several common examples of imputed income are personal use of a company vehicle, group term life insurance with a value over $50,000, gym memberships and fitness incentives (with more than a de minimis, or minor, value), the cost of health insurance for a domestic partner, nondeductible reimbursements for moving expenses and education assistance that is greater than the nontaxable. This concept is known as “imputed income.”. However, these benefits are still taxed as a part of their income.

The irs considers the value of group term life insurance in excess of $50,000 as income to an employee. Employees who have been provided with more than $50,000 of company paid group term life insurance must have reported additional taxable income on their w2 form. (taxable coverrage/$1,000) x age rate = imputed income step 3.

This income is added to an employee’s gross wage so that employment taxes can be withheld. In some cases, an amount “imputed income,” is noncash income and comes from mcps group term life insurance.

Multiply the amount arrived at in step 2 by 12 and divide this. But when it comes to an. Ad affordable, flexible term life insurance at your pace.

Taxable income on imputed premiums.

Vpn Master - Professional Vpn Provider My Love Hair Beauty Food And Drink

What Is Imputed Income On Life Insurance The Insurance Pro Blog

Section 79 - Employee-paid Term Life - Ghb Insurance

Section 79 - Employer-paid Term Life - Ghb Insurance

Smart Benefits Imputed Income For Group Term Life Insurance - Golocalworcester

Group Term Life Insurance A Compliance Primer - Crystal Company

Pin On Sapspot News

Familylaw Fact The Court Will Give Considerable Weight To The Arrangements You And Your Spouse Had Before Separat Family Law Separation Agreement How To Plan

Musings On Markets Numbers And Narrative Modeling Story Telling And Investing - Aswath Damodaran Valuation Drivers Investing Finance Investing Narrator

5 Why Marketing To Your Employees Doesnt Work Linkedin In 2021 Wellness Coach Health And Wellness Coach Soft Skills

How Imputed Income Reporting Works With Your Contributory Life Insurance Plan

2

Life Insurance Tax Calculator Imputed Income For Dynamics Gp

Does Imputed Income Affect Your Contributory Life Insurance Plan Nis Benefits

Vpn Master - Professional Vpn Provider My Love Hair Beauty Food And Drink

Imputed Income Life Insurance Bankrate

Compliance Resources To Strengthen Your Business Life Cycles Strengthen Onboarding

Understanding Life Insurance And Imputed Income

What Is Imputed Income Payroll Definition Examples