What does pro rata mean? In the context of insurance, pro rata often refers to situations in which policyholders can only receive reimbursement for losses that are proportional to the amount of coverage that they have for the entire insured asset.

Insurance Distribution Directive - Ppt Download

In the insurance industry, pro rata means that claims are only paid out in proportion to the insurance interest in the asset;

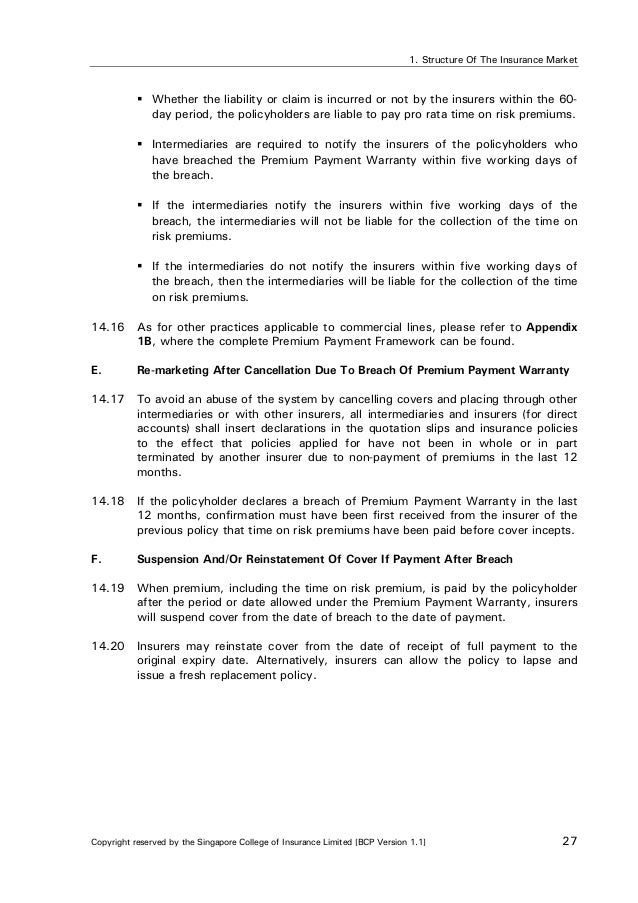

Pro rata insurance definition. A pro rata cancellation is a full refund of any unearned premiums. It is a method of assigning an amount to a fraction according to its share of the whole. A pro rata liability clause is a stipulation in an insurance policy that obliges the insurance company to cover only a percentage of a loss if the insured has other policies from other companies covering the same risk.

If you suffer a $200,000 loss, then the 1 st company will pay 60% of the loss, the 2 nd, 30%, and the 3 rd, 10%. As pro rata stands for in portion, the pro rata clause stipulates that the policy will pay for losses in share to the amount of insurance coverage that the policy has in force. Pro rata (also known as per capita) is usually the term that people are familiar with because it also applies to worker’s pay and benefits, refunds such as a withdrawal from college, partnership liability, and so forth.

$300,000, and $100,000, so you purchase the 3 policies with the maximum limits. Pro rata refers to things that are distributed or divvied out in a means that is proportional. The meaning of pro rata clause is a clause in an insurance policy limiting an insurer's liability for a loss to a proportionate share in relation to coverage collectible from other insurers for the same loss —called also pro rata liability clause, standard other insurance clause.

Pro rata, sometimes referred to as “prorated,” is a latin word used to describe the allocation or assignment of value in a proportionate manner. This is applicable to many insurance transactions, such as insurance payout or cancellation. This amount is proportional to the amount of time remaining on the policy.

In north american countries, pro rata is often referred to or referenced as “ prorated prorated in accounting and finance, prorated means adjusted for a specific time period. After the insurer covers that percentage, the other companies pay for the rest. Check your insurance terms to see what applies to your policy.

Pro rata cancellation — the cancellation of an insurance policy or bond with the return of unearned premium credit being the full proportion of premium for the unexpired term of the policy or bond, without penalty for interim cancellation. Pro rata rate = ( $1,000 (annual premium) / 365) x 76 (two and a half months) pro rata rate = $208 approximately. This is also known as the first condition of average.

Reinsurance agreements under which premiums and losses are shared in some stated proportion. A pro rata clause in an automobile insurance policy provides that when an insured person has other insurance policies covering the same type of risk, the company issuing the policy with the pro rata clause will be liable only for a proportion of the loss represented by the ratio between its policy limit and the total limits of all the available. What does pro rata insurance mean?

Another situation in which these pro rata rates help insurance companies to carefully calculate the exact premium required for a policy is when the policy changes. Pro rata insurance is a kind of policy that upholds a standard of payout that the industry deems proportionate. Pro rata liability means the applicable shareholder or partner ’s allocable portion multiplied by the amount of damages or liability caused by such claim or series of related claims and calculated separately for each such claim or series of.

Pro rata translates to in proportion and means that whatever is being referred to as prorate is being distributed in equivalent rations. Pro rata reinsurance — the reinsurer receives a percentage of premium and pays a proportional share oflosses, above the ceding company's retention. Pro rata is used to describe a proportionate allocation.

Pro rata rate = daily premium x days. A pro rata clause in an automobile insurance policy provides that when an insured person has other insurance policies covering the same type of risk, the company issuing the policy with the pro rata clause will be liable only for a proportion of the loss represented by the ratio between its policy limit and the total limits of all the available insurance. You want to insure a building for $1,000,000, but, for underwriting reasons, the maximum amount that you can purchase from 3 insurance companies is $600,000;

This manner of portioning the coverage concerning the total amount of insurance in force from all other policies helps companies not step on each other’s feet. A pro rata liability clause in an insurance policy may stipulate that an insurer is obliged to cover only a prorated portion of a loss if the insured holds more than one policy with multiple insurance providers to cover the risk in question.

2

Pdf Reinsurance

2

Calculate Pro Rata Everything You Need To Know Tide Business

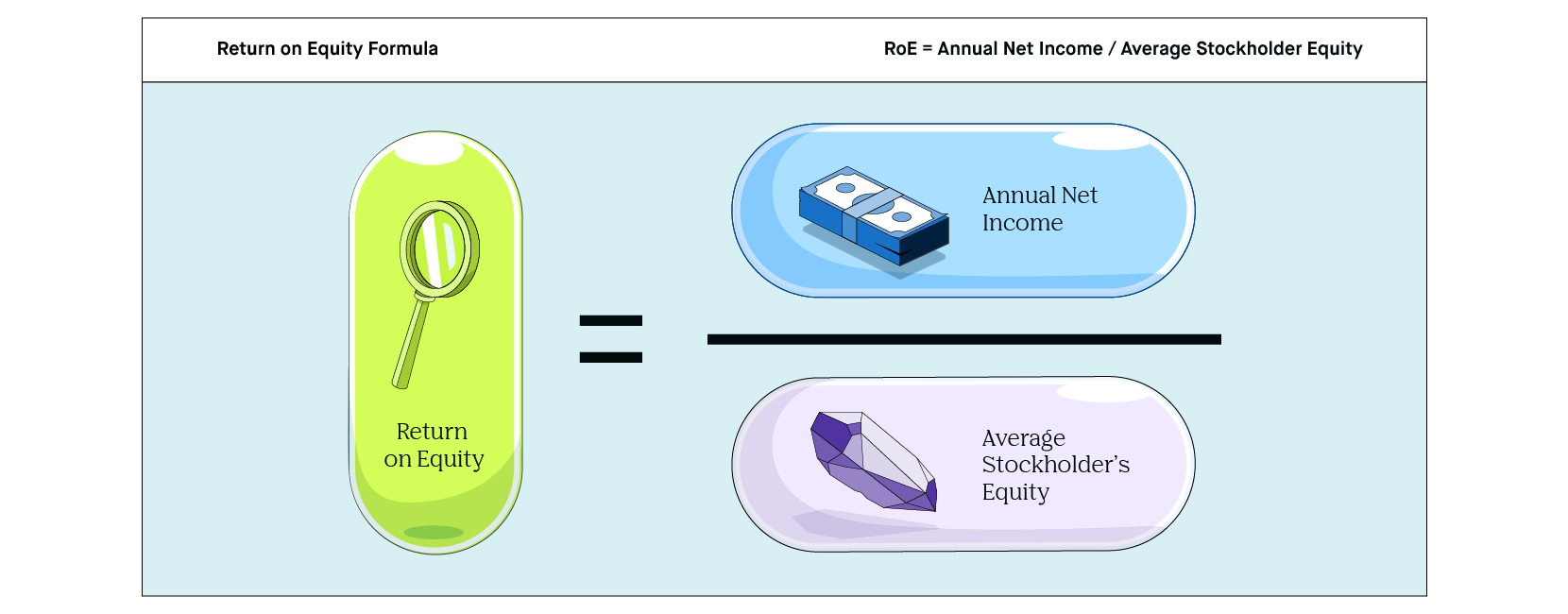

What Is Intrinsic Value - 2020 - Robinhood

2

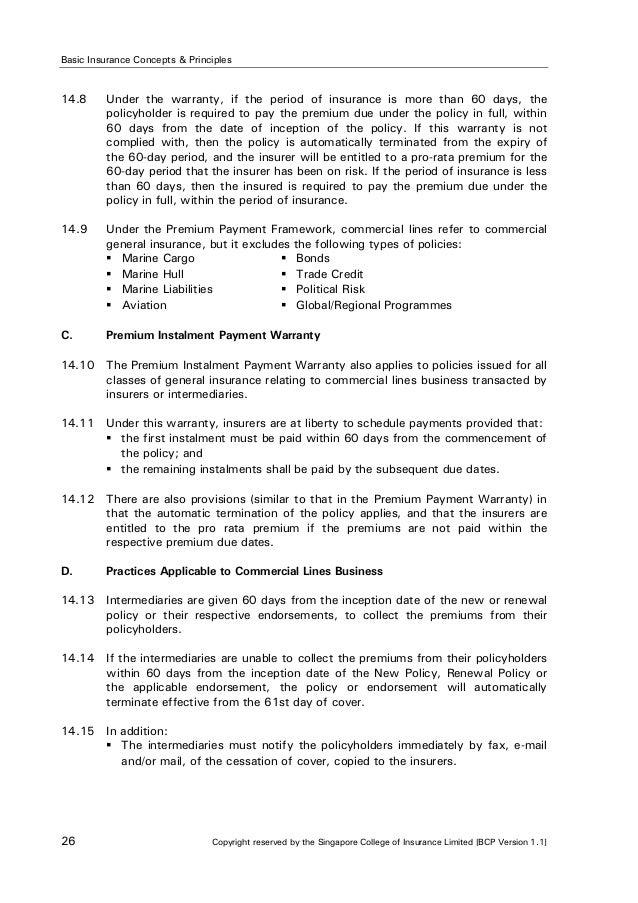

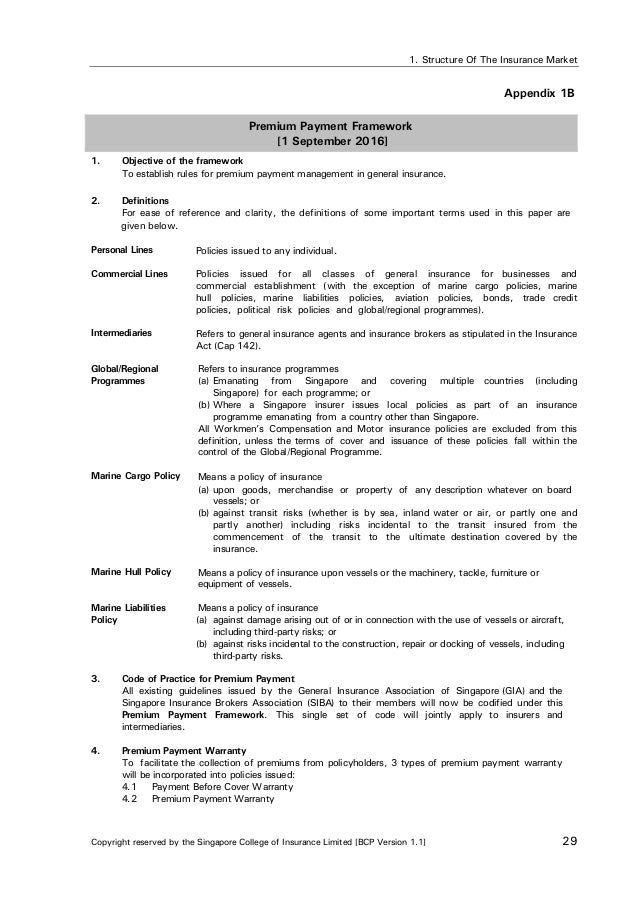

Basic Insurance Concepts And Principles 2016

Calculate Pro Rata Everything You Need To Know Tide Business

Fidelitybondcoverage62514htm - Generated By Sec Publisher For Sec Filing

2

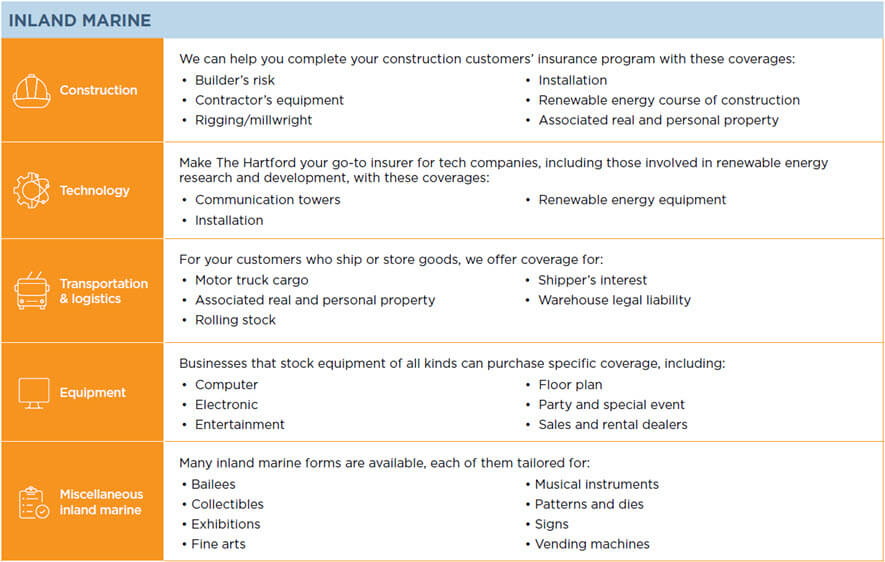

Installation Insurance Business Insurance The Hartford

Basic Insurance Concepts And Principles 2016

Calculate Pro Rata Everything You Need To Know Tide Business

2

Calculate Pro Rata Everything You Need To Know Tide Business

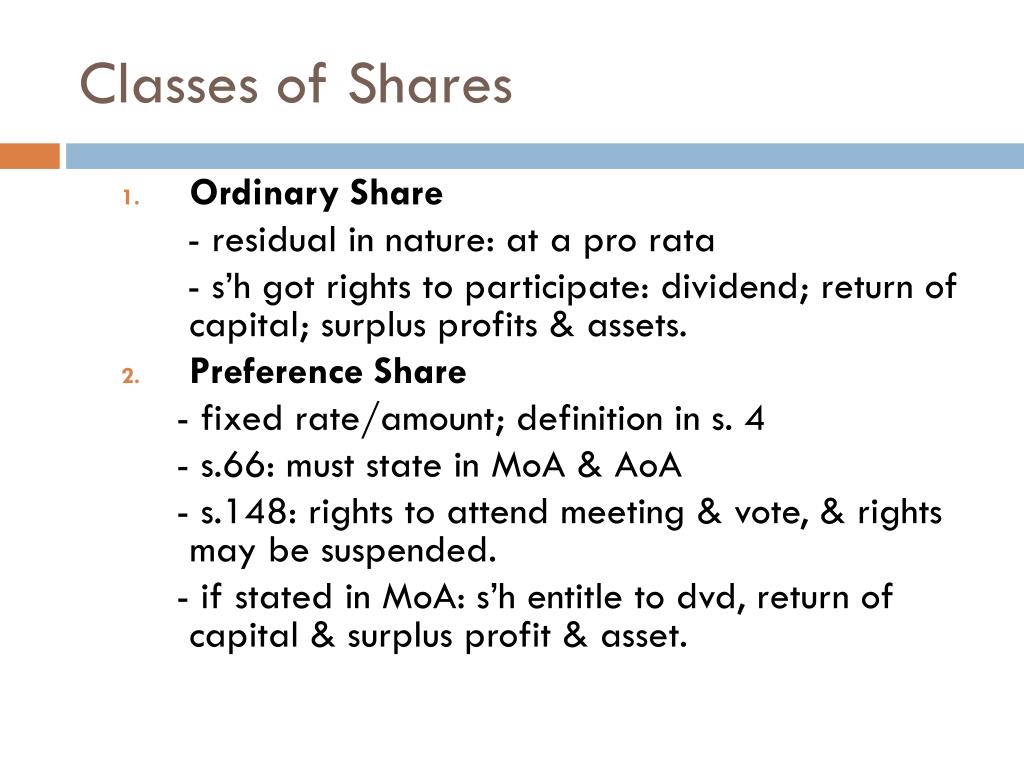

Ppt - Company Finance Share Capital Debt Capital Powerpoint Presentation - Id6593870

2

Basic Insurance Concepts And Principles 2016

Fidelitybondcoverage62514htm - Generated By Sec Publisher For Sec Filing