Additional drivers, or authorized drivers, are different from named insured drivers. The insurers rationale for this exclusion is:

Difference Between Certificate Holder And Additional Insured Difference Between

Adding an additional insured typically increases the premium for the named insured and carries no cost for the newly insured party.

Named insured vs additional insured car insurance. Named insured drivers typically are the owners of an insurance policy on a car they own or lease. Exclusion in professional indemnity/liabilities (“pi/l”) policies. In insurance parlance, a named insured is the person, or organization in whose name an.

Additional insured refers to persons who are not named insured but have been added to the policy by means of endorsement by the named insured. They typically apply to upstream parties contracting work to downstream entities. Insured (“ivi”) has been a traditional.

Naming the principal an “additional insured” would allow them to claim against your insurance. The term has not acquired a uniformly agreed upon meaning within the insurance industry, and use of the term in the two different senses defined above often produces confusion in requests for additional insured status. Named insured vs additional insured named insured vs additional insured named insured vs additional insured.

His or her record is used in underwriting the policy to determine rates, but the person has no policy rights. The named insured in the auto policy is the owner of the vehicle. Insurers are t not comfortable with covering claims between.

Unfortunately, there is often an exclusion on these types of policies called the insured versus insured exclusion which states that no insured can sue another. The first is the named insured, meaning the individual or company designated by name in the policy. Additional drivers versus named insured drivers.

However, the policy will cover the additional insured only for damages that have been incurred for operations that were performed on behalf of the named insured. In the event of a loss, the named insurer is the person that the insurer writes the check to in the event of a loss. This is a summary of a summary of a summary.

“joint insured” means claims could go against either your or their policy. The standard commercial general liability form outlines the parties that qualify for coverage in a section entitled who is an insured. A named insured is entitled to 100% of the benefits and coverage provided by the policy.

Usually, the additional driver is someone who lives with the named insured. For example, the named insured can add or remove coverage, adjust limits and deductibles, and add or remove cars from the policy. •o avoid conflicts of interest, i.e.

The named insured may be a sole proprietorship, partnership, corporation or another type of entity. In this sense, the term can be contrasted with additional insured, a person or organization added to a policy as an insured but not as a named insured. Additional drivers may be listed on a policy, but only named insured drivers can make changes to.

An additional insured is someone who is not the owner of the policy but who, under certain circumstances, may be entitled to some of the benefits and. An additional insured is an entity who is not the policyholder, but is entitled to some of the benefits of the policy because of a direct business relationship to the named insured. An additional driver is a person who resides with the named insured and/or regularly uses a shared vehicle.

The named insured is the only party that has the power to make changes to the policy, cancel the policy, or make any other modifications. In a commercial liability policy the first named insured terminoloy appears in the definitions. Owns the policy, owes the premium, has all the rights.

Since your insurance only covers your negligence, an insurance company may agree to make the principal an additional insured as they are assuming no new or additional risks. What does additional driver mean? •o avoid a collusion between insureds.

A auto policy endorsement is required to be named as an additional insured. Additional drivers are insured on the policy and will have coverage when driving a vehicle, but they won’t receive a payout in their name in the event of an accident. Named insured vs additional insured • the named insured and additional insured are terms that usually appear on an insurance policy.

On the other hand, an additional driver has very little say over the policy. Added to the policy by endorsement due to a relationship with the named insured, and what they get will vary depending on policy form. A typical auto policy additional insured endorsement is the lessor of a vehicle.

Policies can have more than one named insured driver—a spouse, for example. Additional drivers are a different matter. Often an additional named insured is a subsidiary of the first named insured who has the same or very similar operations to the first named insured.

Don't take it at face value. 1) the background for the insured versus insured exclusion. Insureds named under the same policy;

Additional insured endorsements work to shift risk to the party most likely to cause a loss event.

The Difference Between Named Insured Additional Insured And Named Additional Insured Leavitt Group Of Boise

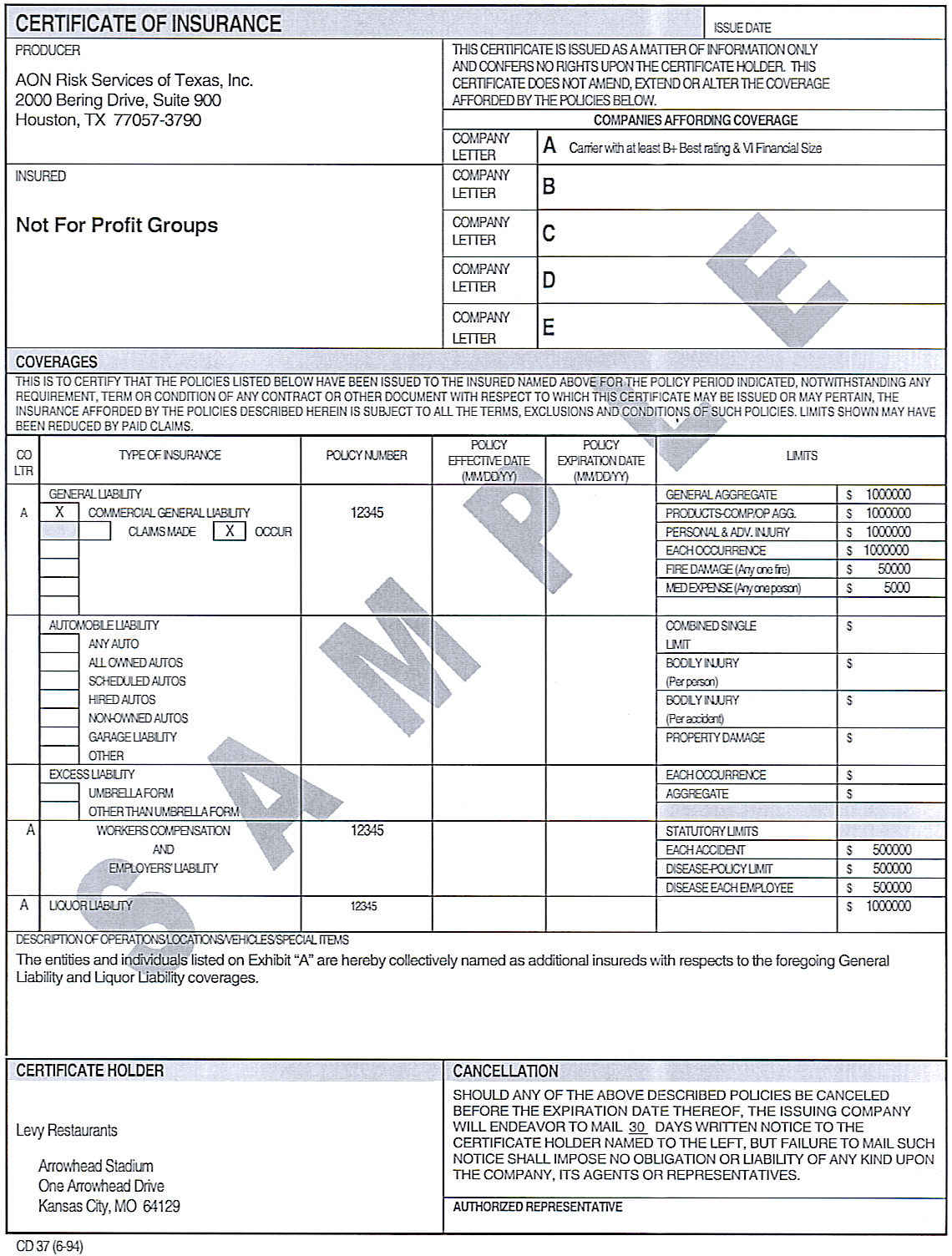

Understanding Your Certificate Of Insurance - Harry Levine Insurance

The Difference Between Named Insured Additional Insured And Named Additional Insured

Difference Between Certificate Holder And Additional Insured Difference Between

2

Additional Insured Endorsements In Construction

Additional Insured Vs Certificate Holder Whats The Difference

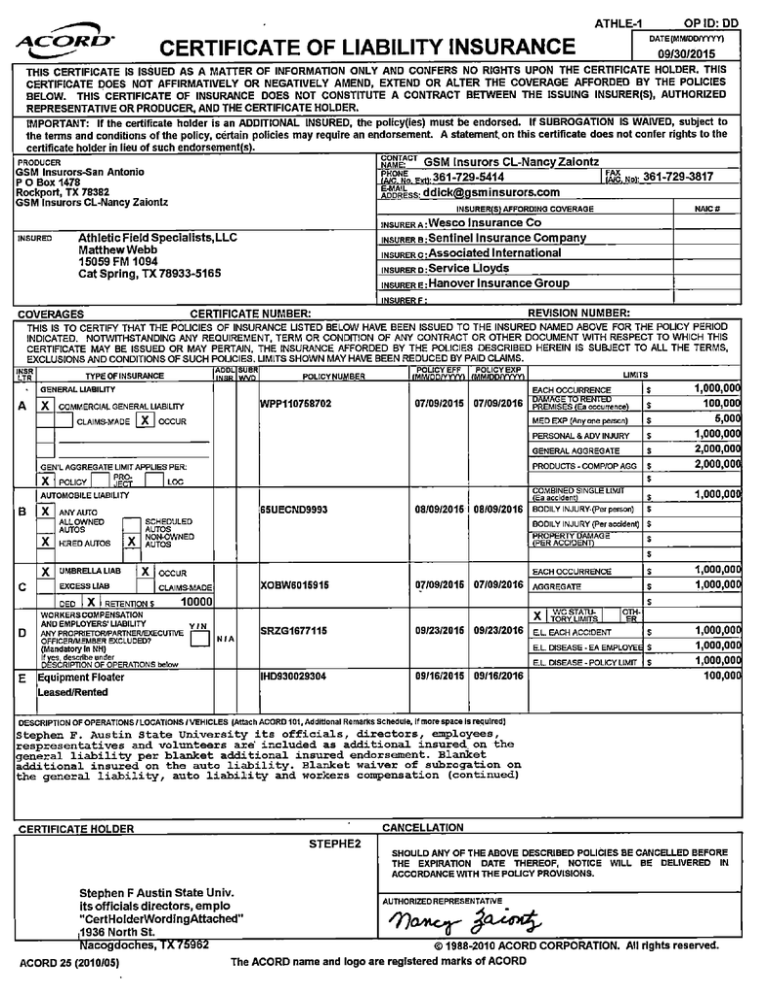

Certificate Of Liability Insurance

Difference Between Certificate Holder And Additional Insured Difference Between

Are You Really An Additional Insured

Protecting Your Firm As An Additional Insured - Virginia Independent Insurance Agent

Additional Insured Vs Loss Payee - Embroker

Whats The Difference Between A Loss Payee An Additional Insured

Named Insured Vs Additional Driver Riskblock

The Additional Insured Endorsement - Briggs Agency

2

The Basics Of Additional Insured Endorsements

Additional Interest Vs Additional Insured Bankrate

Additional Interest Vs Additional Insured Bankrate