They're named on the policy as mortgagee. Is a leading national brokerage built for the challenges of today.

Witkowski Vs Richard W Endlar Ins Agency Inc 81 Mass App Ct 785

So, based on the commentary above, there are two possibilities:

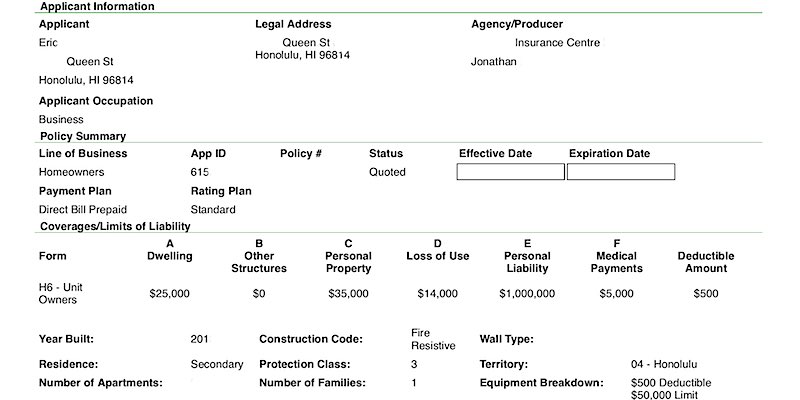

Condo master insurance policy mortgagee clause. Its premium comes out of your maintenance fees or association dues. Condo master insurance policy mortgagee clause 2021. A mortgagee clause naming fannie mae or the lender is not required for a master project property insurance policy, an nfip residential.

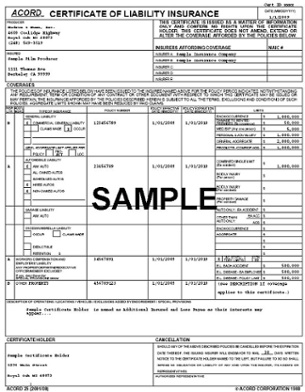

A copy of the current master policy and any endorsements, and a certificate of insurance showing the individual unit securing the mortgage loan is covered under the policy; The 1st step is to place an order, as the information you are requesting is likely already on that certificate. Clause intended to protect the interests of the mortgagees of record in the master insurance policy insuring condominiums is effective in this state.

There is a mortgagee clause in the ho‐6, and a bank who loans anyone $150,000 is going to want to see a piece of paper somewhere saying their investment is protected. Condominium unit owners face just as much risk as homeowners, but they may have different insurance needs based on what the association covers in the master policy. A master insurance policy covers places that are regularly used by multiple condo owners, known as shared or common areas.

(i know, the policy won’t respond to the unit‐owner mortgagee and don’t even start on the $1,000 coverage a point.) 2) the banking industry has not read the condominium association policy. The master insurance policy is subject to section 448.120 which provides as f llows: The mortgagee on the condo unit is not a mortgagee on the jointly owned real property, so stating that they are a mortgagee on the master policy would not be appropriate.

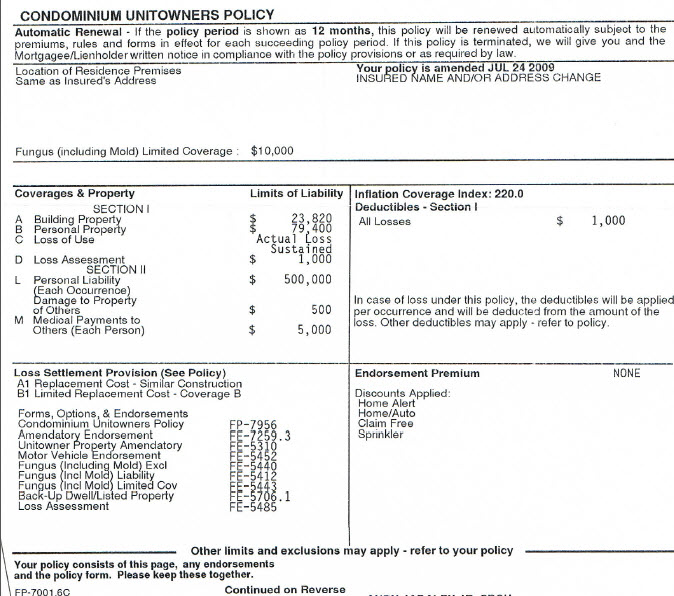

These include fixtures, building service equipment, and common personal property and supplies belonging to the hoa. The policy also must cover fixtures, equipment, and replacement of improvements A condo community insurance master policy with a $5,000 deductible and 20 owners would cost each owner $250 per deductible payment ($5,000/20 = $250).

The master condo policy is responsible for covering two main areas of risk — general liability for the association and property damage coverage for. Complete all the information below to process your request for a certificate. Lenders want to be named as a mortgagee on the policy and get the rights and privileges afforded by the mortgage clause.cancellation notice, coverage if insured commits fraud, etc.

As an insurance csr, he only reason i am not able to issue a certificate is because adding a loss payee & mortagagee on a master condo policy is promising the mortgagee that they will be reimbursed for any loss to the building a building that is also covering 130 other units, if there was a small fire in one of the units imagine the nightmare. Doing so might even be interpreted as insurance fraud, or at least a misrepresentation or false statement under an unfair trade practice or similar law. However, there are more issues concerning the ho‐6.

• policies must include a cancellation provision that provides for at least a 10 day written You might also see this type of policy referred to as condominium association. 11 the manager or the board of managers shall obtain insurance for the property against loss or damage

The master condo policy or condo association insurance is the insurance policy that is held by the homeowners or condominium association. Tenant or said holder(s) of mortgage(s) (or subtenant(s) designated in writing by tenant on its behalf), in its discretion, may carry such insurance as is required by section 19.01 hereof under a blanket fire and other hazards and causes insurance policy or policies issued to tenant or said holder(s) of mortgage(s) (or such subtenant(s)) covering the premises and the improvements. Mortgagee to the master policy.

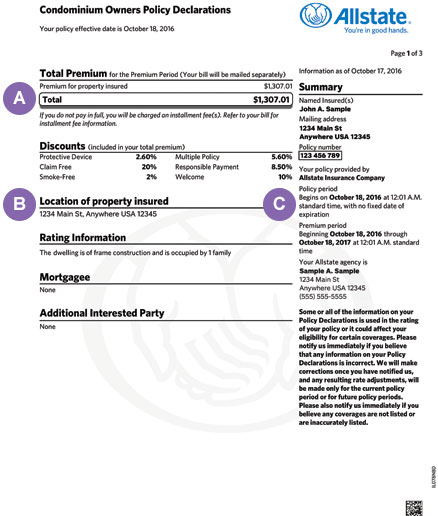

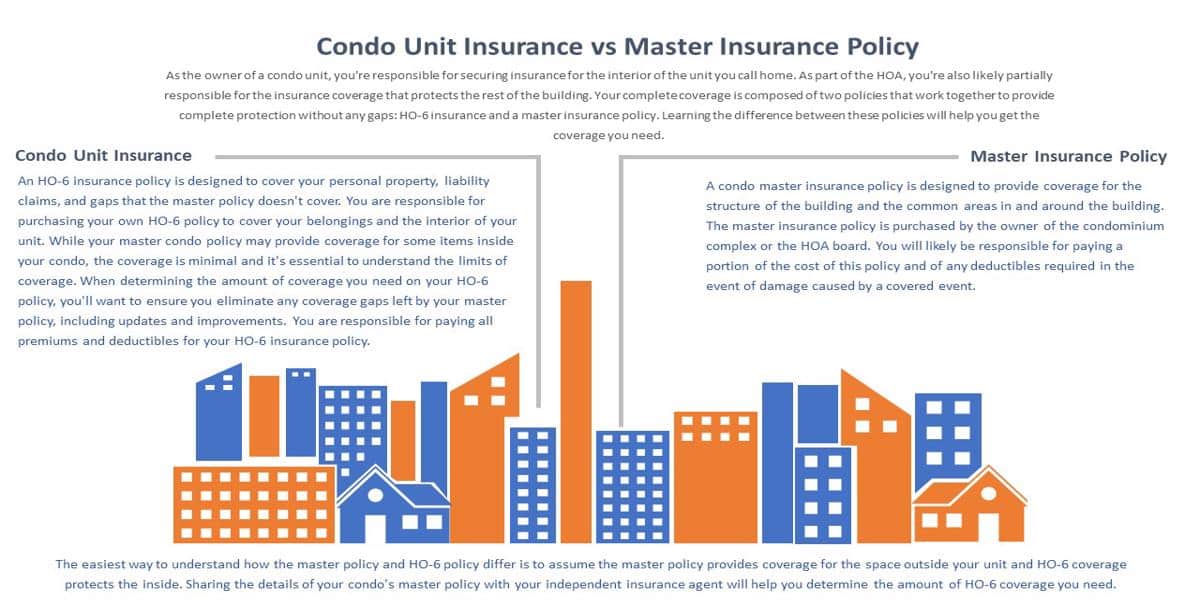

A copy of the current master policy and any endorsements, and a certificate of insurance showing the individual unit securing the mortgage loan is covered under the policy; Condo requirements — the lender must review the entire condo project insurance policy to ensure the hoa maintains a master or blanket type of insurance policy, with premiums being paid as a common expense. A condo master insurance policy is a type of insurance policy that is designed to cover the physical structure of your condominium, as well as any common areas within it.

Common element coverage must also be documented through a master policy. Need to see appraisal but we possibly could need a master insurance policy from the hoa if the subject property is a condo or attached pud. A master insurance policy helps maintain the shared spaces in a condo complex, but having one in place does not mean that unit owners do not need to get their own policies.

Get your condominium master policy certificate. If you still have a policy related question of any kind, or you required additional information be added to the certificate, please email our customer support (cs@icerts.com) to request further assistance. The insurance requirements vary based on the type of hoa master or blanket insurance policy as follows:

Mortgage in lieu of a master policy, fannie mae will purchase loans with individual unit insurance policies that meet the requirements in. That being the case, they have nothing to worry about. Condo master insurance policy mortgagee clause.

If none, please enter none. Mortgagee clause (please consult with the lender for the correct address) bank name: Acceptable evidence of master insurance policies.

Does Your Master Policy Cover Improvement Betterments

Hawaii Condo Insurance The Ho6 Insurance Policy

Rhfemployeecom

Master Policy V Personal Insurance - Pdf Free Download

Condo Insurance Policy Declarations Allstate

Chfaorg

Request A Certificate Of Insurance By Filling In The Form Riskblock

Kcfcmpartnerscom

Bankofamericacom

Real Estatefaq What Kind Of Condo Insurance Do I Need

Do I Need Condo Or Homeowners Insurance Rrealestate

Section 114 Hazard And Flood Insurance - Pdf Free Download

Chfaorg

Condo Associations And Additional Insureds Who Belongs On The Policycondo Associations And Additional Insureds Who Belongs On The Policy

Condo Master Insurance A Master Guide

Assetsnewamericanfundingcom

Allstatecom

Newrezcorrespondentcom

Condominium Unit Owners Comprehensive Form - Pdf Free Download